It’s no secret that I am skeptical of the approach to stimulus via Abenomics. I think it’s potentially creating a very dangerous disequilibrium in markets like their stock market that could cause more economic turbulence than stability. But one thing I definitely don’t think is that Abenomics is going to bankrupt Japan or cause the bond vigilantes to suddenly spring to life. And that’s what many have been implying in recent days.

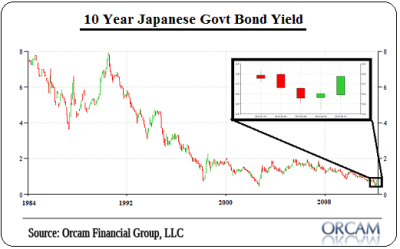

So I’d like to briefly put things in perspective here. The chart below is a 30 year chart of the 10 year Japanese Government Bond yield. As you can see, we’ve experienced a sharp decline from 8% to under 1% at present. That little tiny box in the bottom right hand corner shows the “spike” that many are now discussing as a sign of impending doom. I blew it up for you so you could see what’s happened – we’re all the way back to levels seen….in January of this year.

I’m being a bit sarcastic here of course, but in all seriousness – don’t panic over the yield spike. In the grand scheme of things it takes more than a magnifying glass to actually notice it….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.