My comments about gold during the RT interview with Peter Schiff made a lot of people upset. I’ve received a number of emails, angry comments and forum posts. One of the common responses is to highlight the past performance of gold as a justification for various arguments about the positive aspects of gold.

To begin with, we have to be very careful with past performance. It’s nice to have a historical record of how certain asset classes have performed in the past, but it’s always dangerous to assume that the future will necessarily look like the past. I often gripe about how stock permabulls use a historical record to justify their views. I think this is naive to some degree so we should apply the same thinking here. That said, we do have some evidence to work with and it would be equally naive to totally ignore past performance so let’s actually put these historical figures in some perspective.

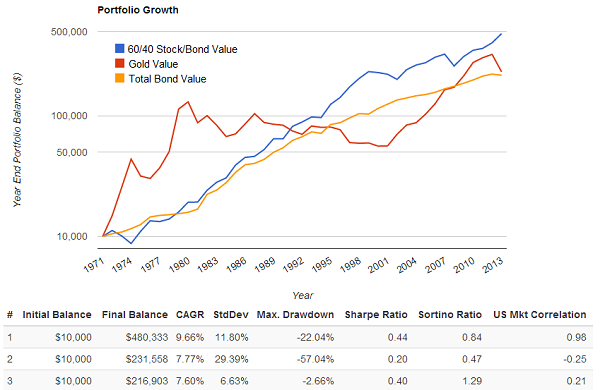

The price of gold was fixed before 1971 so we don’t have as much history as we might like, however, we can still make some sound conclusions based on this time period. So, let’s compare gold with a standard 60/40 stock/bond portfolio and a bond aggregate. The results are pretty clear:

The 60/40 portfolio has outperformed the other two portfolios in nominal returns, but the bond portfolio has the most consistent risk adjusted returns. Therefore, being overweight bonds relative to stocks and gold over this period produced outstanding results (that’s not likely to continue for several reasons so again, take this data with a grain of salt). But the most interesting conclusion is that gold has actually been an atrocious risk adjusted performer. It generates a compound annual growth rate that is the equivalent of the bond portfolio, but does so with over 4X the volatility! Even a pure stock portfolio had a standard deviation that was 40% lower over the same period. Gold’s quantifiable risk is through the roof relative to other assets.

The one nice thing about the performance of gold over this period is that it has provided some non-correlation to other asset classes. This creates increased diversification and could boost the risk adjusted returns of a broader portfolio by having this slice of non-correlation included. But we should not overlook the fact that gold is an extremely volatile asset class that does not tend to perform well on a risk adjusted basis on its own.

So yes, gold has performed fine in nominal terms since the price fix was removed. But it has not been remotely stable. In fact, it has been so volatile that its risk adjusted returns are among the worst of all available asset classes over this period. Most importantly, I would add that the past is not prologue. And my rationale for disliking gold as a substantial holding in any portfolio has nothing to do with past performance, but rests in what I believe is the risk of a collapsing “faith put”. That is, there is a price premium in gold due to its perception as a currency. I personally believe this perception is flawed and I think technology will render it entirely false as time goes on. The future of money is not in rocks, but in spreadsheets on computers. Therefore, it’s my opinion that this faith put will slowly be removed over time as this added demand for gold disappears.

This is why the past data is even more dangerous than many people think. If I am right about my views going forward then gold isn’t just risky based on past performance, but it could be even riskier in the future as the faith put subsides and the myth that “gold is money” disappears.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.