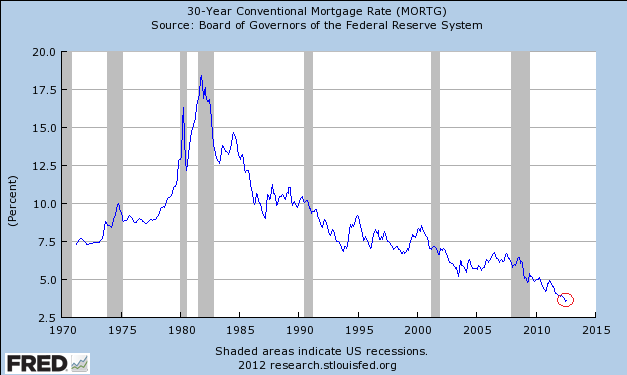

I had to laugh at an advertisement on CNN’s main page this morning. You can see the ad below in the right side of the image next to the atrocious front page story. What it shows is a chart of interest rates and the recent uptick after QE3. And it’s accompanied by a note that says:

“Record-low Rates Tick Up. Refinance before it’s too late”

This thinking is used by many real estate professionals to create a sense of urgency either in refinancing or in buying a home. But the reality is that there is no rush. It’s not going to be too late to refinance or buy a home if you don’t do it tomorrow. How do we know? Well, because the Federal Reserve has told us many times already that rates are going to be at 0% until “at least mid-2015”. That means there will not be any mind-bending rallies at the long end of the yield curve.

But the funnier part about this ad is the “tick up”. Just to put this into perspective, I pulled up a long-term chart of 30 year mortgages. Do you see that “tick up”? I circled it in the bottom right hand corner. If you have a super magnifying glass you can see it. Scary stuff. I’m being a bit of a smart ass, but hopefully you get my point. With the Fed promising to stay at 0% until mid-2015 they’re going to do everything in their power to keep rates low. And since long rates are primarily a function of short rates (which are an indication of the Fed’s view of economic strength) then we can pretty confidently bet that there won’t be a huge surge in interest rates in the coming 2 years. So, as I often say regarding these big personal finance decisions like buying a home – take your time. Be prudent. Don’t rush it because of some misleading advertisement. You have time. Take advantage of it and be smart.

(30 year mortgage)

(scary advertisement)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.