One thing I’ve continually cited throughout Quantitative Easing is how the evidence between stock prices and QE is actually much less reliable than most presume. The case I keep pointing to is Europe where the ECB’s balance sheet expansion has coincided with many markets crashing (like the periphery stock markets). Nevermind that inflation has remained low. There is this perpetual psychological belief that QE can cause stock prices to levitate – as if nothing else is needed to support prices. That is probably true to some degree, but I am not so sure the effect is as powerful as some people seem to believe.

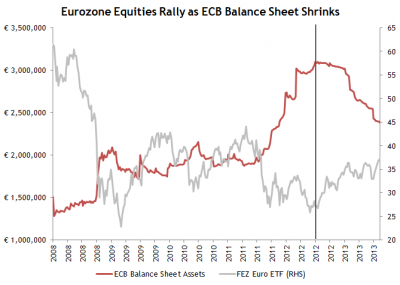

The reason I bring this up is because Scott Krisiloff has a nice post showing exactly what we’re talking about here:

The ECB has a shrinkage problem and a stock market expansion. Which obviously goes against all of the myths that QE’s “tapering” will necessarily coincide with declining stock prices. It all makes me wonder if this isn’t just a big case of confirmation bias. If you can’t find inflation in consumer prices then the default position is to argue that QE causes asset prices to rise. All that “money printing” has to “go somewhere” right? Maybe not….Now, I don’t think that’s entirely irrational as markets are driven largely by psychology, but there are times when this myth seems to take on a life of its own. Maybe Europe proves that we need to temper our taper expectations and stop expecting so much from the Fed’s policies? And maybe it proves that the Bernanke Put is not as important as some people seem to think?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.