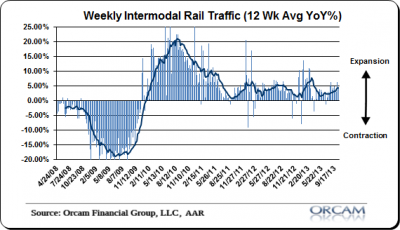

No big change in rail trends this week as the growth continues. The year over year growth in intermodal came to 4% in the latest reading from AAR. This brings our 12 week moving average up to 3.9% which is the highest level in over 6 months. Overall, this indicator has trended very nicely with broader economic growth so if there’s anything to glean from this narrow view here it’s continued growth. I guess the government shutdown didn’t stop the trains from working….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.