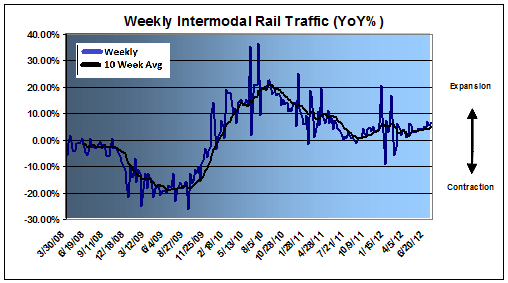

If rail traffic is any indication of future economic growth then things are better than the mainstream media would have us believe. The latest data from the AAR showed another gain in intermodal traffic at 4.1%. This brings the 10 week moving average to 5.1%. Carloads paint a more mixed picture with a decline of 1.5%. Intermodal, historically, has been a better leading indicator of economy growth, however. I think it’s all consistent with a muddle through economy, but not one that’s currently contracting. The AAR has more details:

“AAR today also reported mixed weekly rail traffic for the week ending July 28, 2012, with U.S. railroads originating 288,167 carloads, down 1.5 percent compared with the same week last year. Intermodal volume for the week totaled 250,319 trailers and containers, up 4.1 percent compared with the same week last year.

Twelve of the 20 carload commodity groups posted increases compared with the same week in 2011, with petroleum products, up 46.8 percent; farm products excluding grain up 14 percent, and motor vehicles and equipment, up 8.7 percent. The groups showing a decrease in weekly traffic included metallic ores, down 38.1 percent; iron and steel scrap, down 29.6, and grain, down 7.2 percent.

Weekly carload volume on Eastern railroads was down 3.7 percent compared with the same week last year. In the West, weekly carload volume was even compared with the same week in 2011.

For the first 30 weeks of 2012, U.S. railroads reported cumulative volume of 8,428,551 carloads, down 2.6 percent from the same point last year, and 6,995,801 trailers and containers, up 3.6 percent from last year.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.