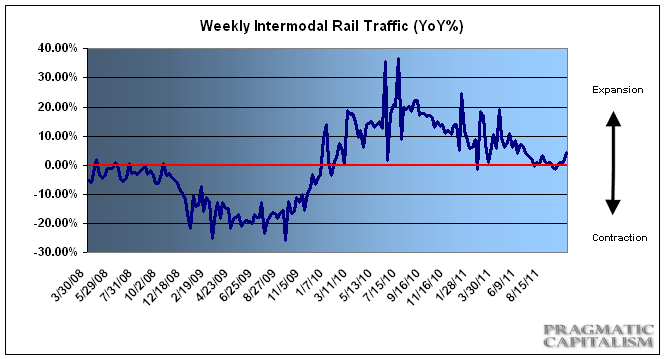

Weekly rail traffic continues to post positive figures despite wide ranging concerns about economic contraction. The latest weekly data from AAR showed a 4.4% jump in total intermodal traffic and a 4.7% increase in carloads. While economic growth might not be booming, there is certainly no sign of a renewed collapse in growth based on this data. Just a slow steady malaise….AAR reports on the details:

“The Association of American Railroads (AAR) today reported gains for September rail traffic compared with the same month last year, with U.S. railroads originating 1,195,671 carloads, up 1.1 percent, and 949,606 trailers and containers, up 2.3 percent. Through the third quarter of 2011, U.S. carloads are at 87 percent of the levels they were at this point in 2006, the highest year on record for U.S. rail traffic. Intermodal volume in the first nine months of 2011 is 96 percent of what it was in the peak year of 2006.

Rail employment continues to make gains, with 1,191 jobs added in August 2011, the latest month for employment data, bringing total Class I freight railroad employment to 160,107. During September, rail car owners brought 11,087 cars out of storage, leaving roughly 17.1 percent of the North American rail car fleet remaining in storage. Detailed monthly data charts and tables will be made available in the AAR’s Rail Time Indicators report to be released tomorrow.

In September 2011, 13 of the 20 carload commodity categories saw increases on U.S. railroads compared with September 2010. The largest gains were: coal, up 6,356 carloads or 1.2 percent; primary metal products, up 5,272 carloads or 14.4 percent, and motor vehicles and parts, up 4,445 carloads or 8.2 percent. In percentage terms, the biggest increase in U.S. carloads in September was in petroleum and petroleum products, up 16.1 percent. Compared with September 2010, grain carloads in September 2011 were down 16,849 carloads or 18.2 percent, continuing a three month-long slide.

“Carloads have been closely tracking last year’s levels for six months, and intermodal continues to grow, though more moderately than earlier this year,” said AAR Senior Vice President John T. Gray. “Rail traffic is consistent with an economy that is probably still growing, but far more slowly than any of us would want.”

In addition, AAR today reported gains in weekly rail traffic, with U.S. railroads originating 312,170 carloads for the week ending Oct. 1, 2011, up 4.7 percent compared with the same week last year. Intermodal volume for the week totaled 250,864 trailers and containers, up 4.4 percent compared with the same week last year. This week’s U.S. carload volume is highest since Week 45 of 2008, and the intermodal volume is the highest since Week 39 of 2007.

Fourteen of the 20 carload commodity groups posted increases from the comparable week in 2010, including: metallic ores, up 24.9 percent; metals and products, up 17.5 percent, and nonmetallic minerals, up 16.6 percent. Groups showing a decrease in weekly traffic included: farm products excluding grains, down 21.4 percent; grain, down 17 percent, and waste and nonferrous scrap, down 11.2 percent.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.