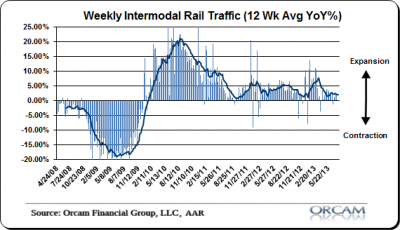

More of the same here in rail traffic trends. It’s not great and it’s not terrible. Most importantly, it’s not contracting. The 12 week moving average came up to 2.2% this week which is right in-line with the general economic conditions. Here’s a bit more detail from AAR:

“The Association of American Railroads (AAR) reported increased weekly rail traffic for the week ending July 27, 2013, with total U.S. weekly carloads of 295,532 carloads, up 2.5 percent compared with the same week last year. Intermodal volume for the week totaled 256,379 units, up 2.4 percent compared with the same week last year. Total U.S. rail traffic for the week was 551,911 combined carloads and intermodal units, up 2.5 percent compared with the same week last year.

Six of the 10 carload commodity groups posted increases compared with the same week in 2012, led by petroleum and petroleum products with 13,076 carloads, up 23.2 percent. Commodities showing a decrease compared with the same week last year included grain with 17,213 carloads, down 7.6 percent.

For the first 30 weeks of 2013, U.S. railroads reported cumulative volume of 8,315,858 carloads, down 1.3 percent from the same point last year, and 7,234,039 intermodal units, up 3.4 percent from last year. Total U.S. traffic for the first 30 weeks of 2013 was 15,549,897 carloads and intermodal units, up 0.8 percent from last year.”

Chart via Orcam Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.