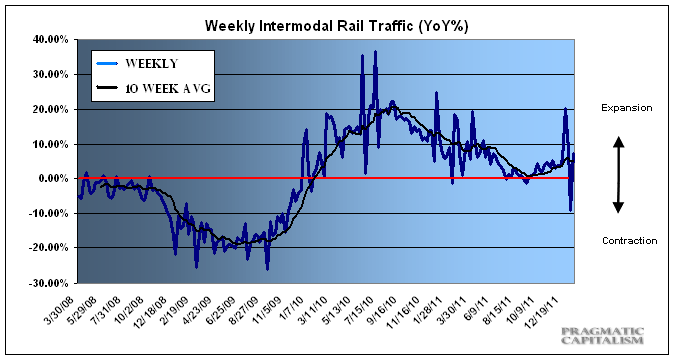

Rail traffic is showing big gains this week after last week’s sharp decline. The data has been choppy over the last few weeks, but the 10 week trend remains firmly positive. The volatility is not unusual in this data so it’s important to maintain some perspective of the trend. Total carloads were up 5.5% compared to last year while intermodal traffic rose 7.4%. ARR has more details on the data:

“The Association of American Railroads (AAR) today reported an increase in weekly rail traffic for the week ending January 14, 2012, with U.S. railroads originating 298,560 carloads, up 5.5 percent compared with the same week last year. Intermodal volume for the week totaled 229,091 trailers and containers, up 7.4 percent compared with the same week last year.

Seventeen of the 20 carload commodity groups posted increases compared with the same week in 2011, with crushed stone, sand and gravel, up 33.2 percent; motor vehicles and equipment, up 31.5 percent, and petroleum products, up 28.9 percent. The groups showing a significant decrease in weekly traffic included grain, down 10.1 percent.

Weekly carload volume on Eastern railroads was up 5.3 percent compared with the same week last year. In the West, weekly carload volume was up 5.6 percent compared with the same week in 2011.

For the first two weeks of 2012, U.S. railroads reported cumulative volume of 573,412 carloads, up 0.9 percent from last year, and 422,903 trailers and containers, down 1 percent from last year.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.