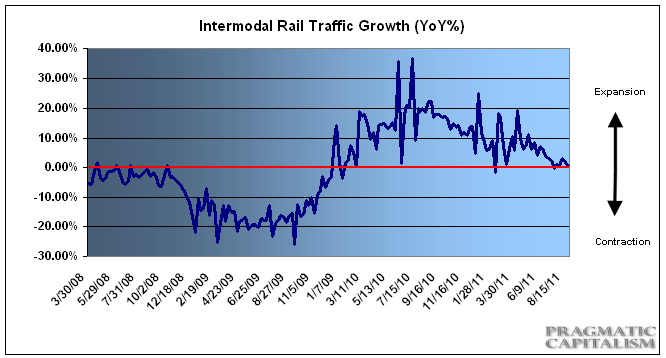

If recent rail data is any indication, we can take solace in the fact that the data is not cratering. A brief glance at some of the recent economic data and market action might have you thinking otherwise. But this economically sensitive industry continues to show stagnation and not collapse (that’s the modern day version of a bullish argument – sad, I know). The latest from the AAR reports a slight decline in overall carloads, but an increase in intermodal.

“The Association of American Railroads (AAR) today reported mixed results for weekly rail traffic, with U.S. railroads originating 292,266 carloads for the week ending August 13, 2011, down 1.2 percent compared with the same week last year. Intermodal volume for the week totaled 235,598 trailers and containers, up 0.8 percent compared with the same week last year.

Eleven of the 20 carload commodity groups posted increases from the comparable week in 2010, including: metallic ores, up 25.2 percent; iron and steel scrap, up 22.4 percent, and petroleum products, up 15.8 percent. Groups showing a decrease in weekly traffic included: farm products excluding grain, down 25.1 percent; waste and nonferrous scrap, down 20.3 percent, and nonmetallic minerals, down 13 percent.

Weekly carload volume on Eastern railroads was flat compared with the same week last year. In the West, weekly carload volume was down 1.9 percent compared with the same week in 2010.

For the first 32 weeks of 2011, U.S. railroads reported cumulative volume of 9,230,496 carloads, up 2.1 percent from the same point last year, and 7,222,948 trailers and containers, up 6.5 percent from last year.”

Source: AAR

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.