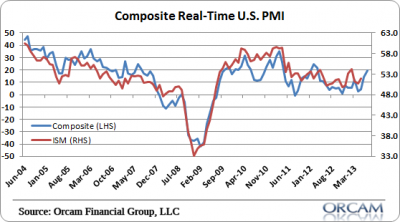

Today’s Dallas Fed Manufacturing Index update gives us a broader look into the state of US manufacturing and it’s telling us that not a whole lot has changed in recent weeks. The Dallas Fed survey came in at 4.4 which was down was last month’s reading of 6.5. This brings the Real-Time Composite down to 19.6, which is consistent with roughly 53 on the PMI report. That’s almost precisely what the Flash PMI showed last week. We’ll get the official reading later this week.

For now, it looks like more of the same. Slow growth, but growth. The Dallas Fed has more details on the report:

Texas factory activity continued to expand in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 17.1 to 11.4, suggesting output growth continued but at a slower pace than in June.

Some other measures of current manufacturing activity also indicated slower growth in July. The new orders index was positive for the third month in a row, although it edged down from 13 to 10.8. The capacity utilization index also slipped slightly, falling three points to 12.2. However, the shipments index inched up to 17.7, reaching its highest reading in six months.

Perceptions of broader business conditions improved again in July. The general business activity index posted a second consecutive positive reading, although it edged down from 6.5 to 4.4. The company outlook index also remained positive but fell, coming in at 4.5.

Chart via Orcam Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.