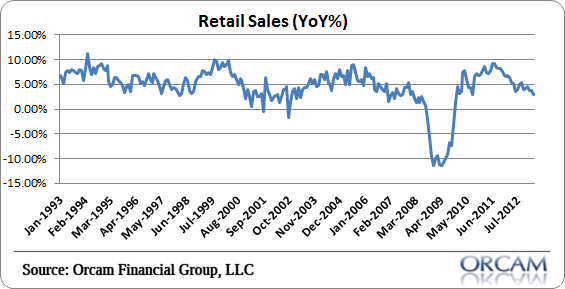

Is the sequestration and payroll tax increase starting to bite a little bit? That might be the big takeaway from today’s retail sales report which came in at -0.4% vs expectations for 0%. The year over year change came in at 3% which isn’t bad at all, but has basically been on a steady downtrend since 2011. The current reading was its weakest since August 2010 (see figure 1 below). In addition, the prior two months were revised down sharply.

Econoday has more on the specifics:

“Retail sales in March came in below expectation and weakness was broad based. Retail sales declined 0.4 percent, following a surge of 1.0 percent in February (originally up 1.1 percent). Market expectations were for no change.

Ex-auto sales in March declined 0.4 percent after a jump of 1.0 percent in February (originally up 1.0 percent). The consensus projected a 0.1 percent advance for March. Gasoline sales were down significantly on lower prices. Excluding both autos and gasoline components, sales slipped 0.1 percent after increasing 0.3 percent in February (originally up 0.4 percent). Analysts forecast a 0.3 percent gain.

Motor vehicle sales decreased 0.6 percent, following a 1.3 percent rise in February. On lower prices, gasoline sales fell 2.2 percent after spiking 5.4 percent in February.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.