We got some great responses to the Merrill Lynch report last week (I highly recommend reading the comments) which argued that the Shiller P/E ratio was not useful and that its high current reading was misleading. The following excellent response comes from JJ Abodeely, CFA who writes Value Restoration Project:

Last week, Cullen Roche over at Pragmatic Capitalist covered a research report written by David Bianco, Chief US Market Strategist at Merrill Lynch, questioning the utility of the Shiller P/E. He thought Bianco “made a pretty strong case.” I felt otherwise and after reading several reports by ML on the topic I have a more thoughtful view of where their analysis and application of a normalized P/E falls short.

ML’s shortcomings start with the very premise of why determining what the level of normalized earnings is to begin with. From their piece:

“Perception of normal EPS and confidence in such drives short-term performance. Actual EPS through the full cycle drives most of long-term market performance.”

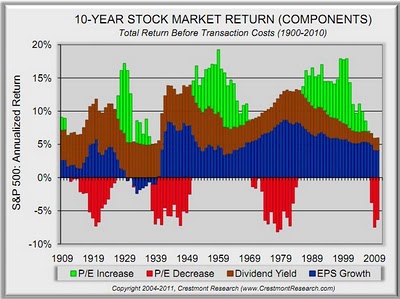

The EPS measure from Shiller’s Cyclically Adjusted P/E and other well crafted versions of normalized earnings, such as Crestmont’s business cycle-adjusted EPS, are useful, even essential, because they help us to smooth out the business cycle and determine whether or not the current PRICE of the market is cheap or expensive and thus whether future returns will be high or low.

So, it makes sense that Bianco and Merrill aim to improve upon Shiller’s P/E. Their most serious critique of the Shiller P/E, however, is also their most dubious argument:

Shiller’s PE understates normalized EPS

Shiller’s PE cannot be fairly compared across time because it neglects substantial shifts in dividend payout ratios over the last 110 years. Anytime the dividend payout ratio is not 100% EPS should rise with inflation plus the return on reinvested earnings (an expected real ROE). This is called an Equity Time Value Adjustment (ETVA). Shiller’s EPS does not fairly represent normal EPS because it assumes EPS only grows by inflation, which given a decade of high EPS retention, is flawed.

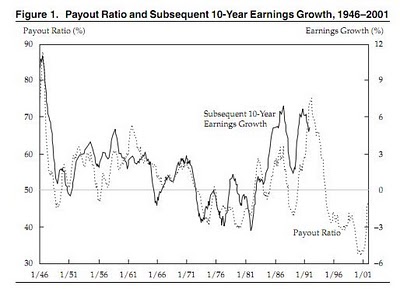

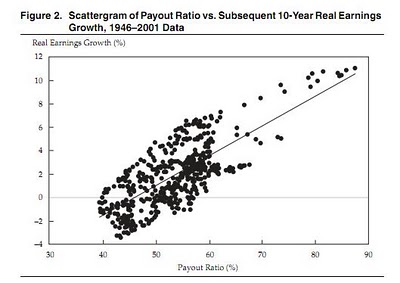

As several comments on the original Prag Cap post pointed out, higher retained earnings (lower dividend payouts) does NOT equal higher earnings growth. Merrill’s logic assumes that companies can infinitely reinvest earnings into their business at a given ROE without degrading it, when the experience of companies in the real world says otherwise. That is why good companies return cash to shareholders, because they know that at some level of retained earnings (different for each company), the reinvestment opportunities are limited without accepting lower returns. Research by Cliff Asness and Rob Arnott (Surprise! Higher Dividends = Higher Earnings Growth) proves this empirically (the charts below are theirs). Real world experience as an investor has taught me that companies that pay higher dividends actually have HIGHER earnings growth, precisely BECAUSE of the discipline it forces on executives regarding what they do with earnings.

So how does Merrill propose to improve upon the Shiller P/E? From the piece:

We adjust our normalized EPS estimate, which is based on pro forma EPS, for accounting quality. In our view, the best EPS measure for valuation generally lies between pro forma and GAAP EPS. Our accounting quality adjustment is made to ensure that EPS represents cash flow available for distribution or reinvestment. Our adjustment is based upon historical GAAP versus pro forma EPS differences and comparing pro forma EPS to adjusted cash flow measures.

The most glaring problem here is the use of pro forma operating EPS. I’m no accounting expert, but I know one thing: pro-forma operating EPS is what company management uses to make their results look as good as possible without being accused of wrongdoing. Stock option expense? It’s not real money. Business restructuring? One-time event. Overpaying for an acquisition? Just a non-cash write down. Merrill makes a “quality adjustment” and describes that adjustment without giving enough detail to support it. See the discussion of the $8 adjustment below for reasons to believe their process is less than inspiring.

Bottom line, while GAAP EPS in any given year is not a perfect measure of normalized earnings, a 10 year adjusted average should smooth out those imperfections and is certainly better that using the fiction that is pro forma operating EPS.

The next step of Merrill’s process takes their flawed EPS number and makes the following adjustment:

Normalized EPS: Represents what EPS would be in the current year if the current year were more in the middle of the economic cycle. We forecast the year when EPS returns to normal and use an equity time value discount rate (nominal cost of equity less the dividend yield) to discount that future EPS back to the year for which we are estimating normalized EPS

They take a highly problematic operating EPS forecast and try to adjust it for quality (difficult), forecast the year when EPS returns to normal (heroic), establish what that level of EPS is going to be (requires clairvoyance) and then discount that perfect number back to present. This resembles nothing close to the normalized and unbiased level of earnings that could be used to determine the long-term valuation of the market.

In fact, it seems remarkably like just another forward earnings estimate which we know are incredibly unreliable. Read far enough along and Bianco and team reveal their true intention:

While we consider the Shiller PE a useful tool we think it is often misinterpreted and does not serve as a substitute for fundamental forward looking views on EPS.

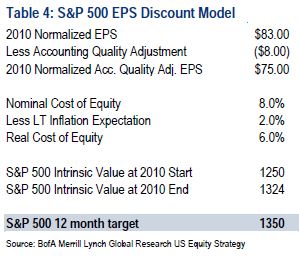

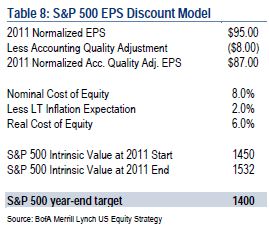

Indeed, their normalized EPS measure is nothing of the sort, but instead a measure which attempts (and fails) to assign theoretical underpinning to the often senseless world of top-down pro forma operating EPS forecasting. In less than 10 months, their normalized measure for earnings at 12/31/10 has grown by 9.5%. If their process held up, there would not be such dramatic swings in the “Intrinsic Value” of the market. The value at the end of 2010 would be the same as the Intrinsic Value of the market at the beginning of 2011 shown in the tables below.

The fact that the quality adjustment stands at $8 regardless of the level of the normalized measure (9.6% of the 2010 earnings, 8.4% of the 2011 measure) is yet another piece of evidence that their approach lacks rigor.

April 22, 2010

Okay, so they have a different methodology for calculating normalized EPS and one that we have reason to be critical of. But HOW DO THEY USE IT? Is it helpful for understanding the “probable outcomes” for the market?

Accounting Quality Adj. Normal EPS / Fair Real Cost of Equity = Fair ValueFair cost of equity estimate = Fair ERP + US Treasury bond yields

Our method of estimating a fair return on long-term S&P 500 investment, which is known as the S&P 500’s cost of equity, is to add an Equity Risk Premium (ERP) to US Treasury bond yields. Our fair ERP estimate is based upon the history of S&P 500 returns relative to Treasury bond returns. Using history as a guide, we assume a fair future ERP on S&P 500 investment of 3.50%. History supports a fair ERP in the range of 300-400bp for long-term S&P 500 investment. Because our fair ERP estimate aims to capture normal conditions, which should prevail over time, we add our fair ERP estimate to current Treasury bond yields which we attempt to normalize for cyclical influences. The goal is to estimate a normal Treasury bond yield and a normal S&P 500 ERP on a prospective basis.

S&P 500 Fair Cost of Equity = Normal Treasury Bond Yield + Normal ERP8.0% = 4.5% + 3.5%Subtracting long-term expected inflation gives the fair real S&P 500 cost of equity.S&P 500 Real Cost of Equity = 6.0% (8% – 2%)Fair Acc. Quality Adj. PE = 16.5 = 1/6%

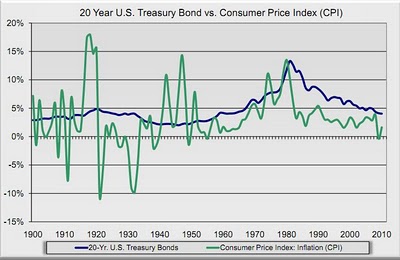

Frankly, I’m a little surprised that they would be this sloppy– if Merrill was really using history as a guide, they might draw different conclusions. I won’t even address the challenges of estimating a “long-term expected inflation” or “Normal Treasury Bond Yield” which itself fluctuates widely over time and can be influenced by policy, politicians, helicopters and a printing press. The long-term history of long-rates courtesy of Crestmont is below.

The EPS measure from Shiller’s Cyclically Adjusted P/E and other well crafted versions of normalized earnings, such as Crestmont’s business cycle-adjusted EPS, are useful, even essential, because they help us to smooth out the business cycle and determine whether or not the current PRICE of the market is cheap or expensive and thus whether future returns will be high or low.

So, it makes sense that Bianco and Merrill aim to improve upon Shiller’s P/E. Their most serious critique of the Shiller P/E, however, is also their most dubious argument:

Shiller’s PE understates normalized EPS

Shiller’s PE cannot be fairly compared across time because it neglects substantial shifts in dividend payout ratios over the last 110 years. Anytime the dividend payout ratio is not 100% EPS should rise with inflation plus the return on reinvested earnings (an expected real ROE). This is called an Equity Time Value Adjustment (ETVA). Shiller’s EPS does not fairly represent normal EPS because it assumes EPS only grows by inflation, which given a decade of high EPS retention, is flawed.“Perception of normal EPS and confidence in such drives short-term performance. Actual EPS through the full cycle drives most of long-term market performance.”

To begin with, the Equity Risk Premium is infamously unstable. As Rob Arnott pointed out near the 2009 bottom of the stock market, “the 40-year excess return for stocks, relative to holding and rolling ordinary 20-year Treasury bonds” was NOT EVEN ZERO! Certainly, 40 years qualifies as “long-term” and as recently as two years ago, there was no excess return (which is the realized equity risk premium) to stocks!

Okay, maybe that was the 100 year flood, so what is the excess return that investors can expect from stocks versus bonds over the SUPER long term? 3.5% as David Bianco at Merrill suggests? Peter Bernstein and Rob Arnott disagree. In their 2002 “What Risk Premium Is ‘Normal’?” they show (with 207 years of data) that the Equity Risk Premium (or excess return) is empirically 2.5%. As I highlighted in another post, if you remove the bubblicious 90s, the ERP or excess returns to stocks is more like 1.5%. The fact is that Wall Street has created a false dogma about what stock market investors “deserve” or can expect in returns relative to bonds and Bianco’s “research” is designed to fit right into that storyline. Wall Street was able to get away with this sort of thing because the market returns of the 80s and 90s were so strong, however investors are wising up and realizing that there is no “natural” return to equities and that what you pay matters.

The idea that Bianco is trying to sell us something is confirmed by his selective use of history:

S&P currently trading at 14.7x 10yr ETVA trailing EPS, vs. 1960-2009 10yr ETVA trailing EPS PE of 15.6x, suggests that the market is attractive vs. history on this method.

Come on. The analysis limits the comparison to the last 50 years, because it results in a higher average PE (14-19% higher depending on methodology) and makes the current market valuation seem more reasonable. Bianco’s time period puts even more weight in the lofty valuations of the bubblicious 1990s.

I hope I’ve made the case that David Bianco and Merrill Lynch US strategy team has missed the mark with their critique of the Shiller P/E, their attempt at a better measure, AND their application of the measure to draw conclusions about the probable returns for the stock market.

Expect a future post from VRP on why and how we should be using a normalized P/E ratio to determine the likely future returns to stocks.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.