In this morning’s research note David Rosenberg makes the case for a QE3. He writes:

“HOW CAN THERE NOT BE A QE3?

Keep in mind that the Fed, unlike the ECB, has a dual mandate – and the one pertaining to the goal of full employment is becoming even more elusive. The unemployment rate has already gone from 8.8% three months ago to 9.2% as of June and that is now well outside the year-end FOMC central-tendency projection band of 8.6 to 8.9%. The Fed believes it will be down to 7.8% – 8.2% by the end of 2012. Good luck.

The economy is going to need a lot more help to get to these numbers – not to mention the 3.2% consensus GDP growth forecast for the second half of the year. It looks like the majority of economists are in for another big surprise as they were heading into 2008 where visions of soft-landings filled the air.

Keep in mind that every recession was ushered in by a rise in the unemployment rate of 0.5 percentage points or more. We have no gone up 0.4 of a percentage point. Just another 10 bps to go before the sufficient condition kicks in.”

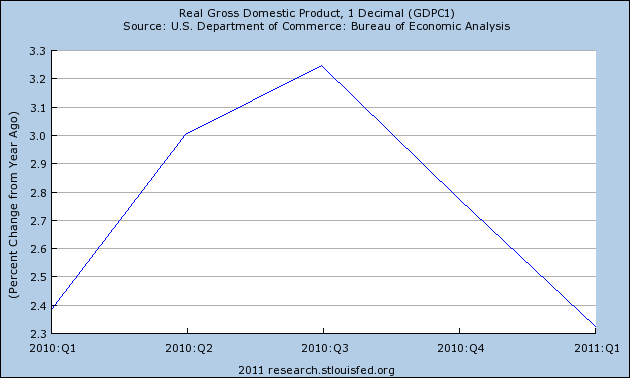

The logical conclusion is that most market participants still think the Fed has to implement a QE3 in order to “boost” the economy. I am nearly dumbfounded at these conclusions. As QE2 ended it became abundantly clear that the program did little to nothing for the real economy. In fact, the only real impact appears to have been a margin squeeze on the entire economy as it boosted cost push inflation and caused no increase in aggregate demand. The end result was real GDP that peaked as soon as QE2 began. Stare deep into this chart for the only evidence you really need:

QE2 did not do what it was expected to do. It arguably made things worse. The logic behind a QE3 simply doesn’t exist…..So, the more important question is not “how can there not be a QE3”, but rather “how can the Fed possibly justify a QE3?”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.