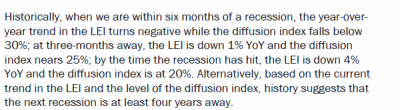

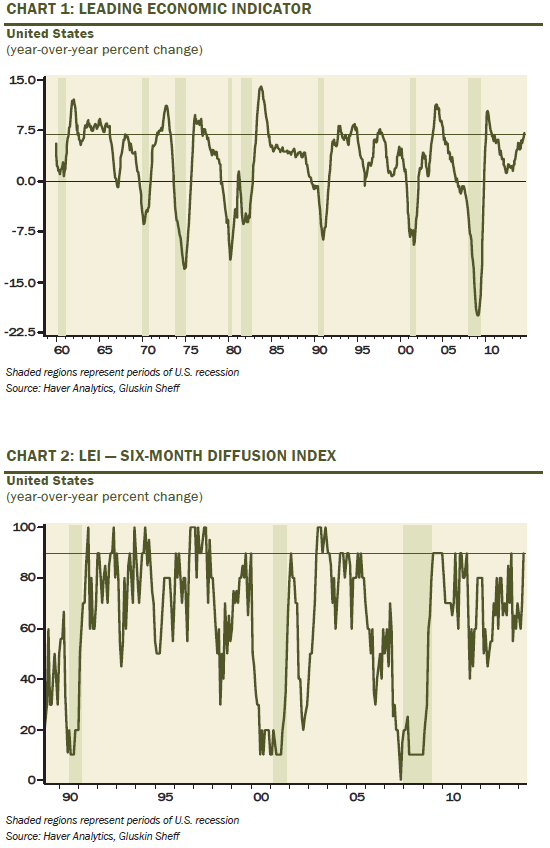

Talk about a flip in perspective. David Rosenberg, who had been bearish for years, has turned into one of the biggest bulls on Wall Street. The Gluskin Sheff analyst now says his recession forecasting model could be pointing to another four years of economic expansion (via a recent note of his):

That’s pretty interesting. We know that the probability of a tail risk event increases dramatically inside of a recession. So if DR is right then that means the macro trend could be higher for several more years to come….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

jdogg13

Then why does the Fed still have its emergency policies (ZIRP/QE) still in place?

John Smith

Merrill’s Rosenberg: A New Bull Market? Are You Out Of Your Mind?

Henry Blodget

Apr. 2, 2009, 6:27 AM

Merrill’s departing economist thinks the S&P will trade between 475 and 650 “for an extended period of time.” That’s 20%-40% below today’s level.

https://www.businessinsider.com/henry-blodget-merrills-rosenberg-a-new-bull-market-are-you-out-of-your-mind-2009-4

Shervin

Because inflation is low and unemployment is still relatively high. The Fed will also allow inflation to rise higher than its target because they are afraid of prematurely tightening and killing the recovery.

Guest

Well, the stock market doesn’t need a recession to go down, does it?

John Daschbach

Without seeing the DI on the same scale as the LEI it’s impossible to verify the claims. All of this seems like such sophomoric data analysis compared with the state of the art today that all I can conclude is that these are people who make their income by duping others that they have anything valuable to say. I’m sure anyone involved in Chemometrics, Bioinformatics, Econometrics, WebSearch, WebCookies, … is flabbergasted that people in the financial world publish stuff like this and are considered valued members of the community instead of the crackpots they are. Doing this “correctly” has ben the brea and butter of Bioinformatics and Chemometrics for a couple decades. It’s impossible to believe that the real actors in finance are not using these same analysis. Perhaps that what bothers so many people about finance these days.

Willy1964

Certainly sounds credible. But if Rosie only looks at the LEI &the DI.

Willy1964

The FED does NOT determine interest rates !!! It’s determined by a force called “Mr. Market” and the FED follows the markets.

TimeToPanic

Poor Rosie. Wrong on the way up, and will be wrong on the way down too.

mpstrunk

The FED does determine one interest rate. Its called the FED Funds Rate. It can set this rate at whatever it wants.

Willy1964

No, it doesn’t

mpstrunk

This would be a good question for “Ask Cullen”

Willy1964

Yes, it determines that rate but at the same time it follows the market rate for the 3 month T-bill rate.

The last time the FED didn’t follow the market rate was in 1981 when Volcker hiked rates by 2%.

Willy1964

No, it isn’t because Cullen also erroneously thinks that the FED determines that rate.

Willy1964

Yellen has already signaled that she WILL (like Volcker) crank up rates, No, NOT because of “Inflation” but in order to defend the US bond market.

The US has a current Account Deficit and is dependent on the kindness of strangers to fund the federal deficits. and those strangers/foreigners are increasingly unwilling to keep funding the US.

We saw the same situation in Turkey in january of this year. Turkey is in precisely the same situation as the US is in. Turkey hiked rates in an attempt to defend the turkish lira(/pound ??) & the turkish bond market.

Willy1964

Turkey hiking rates:

https://www.reuters.com/article/2014/01/28/us-turkey-centralbank-rates-idUSBREA0R1W420140128

mpstrunk

You mean you disagree with Cullen