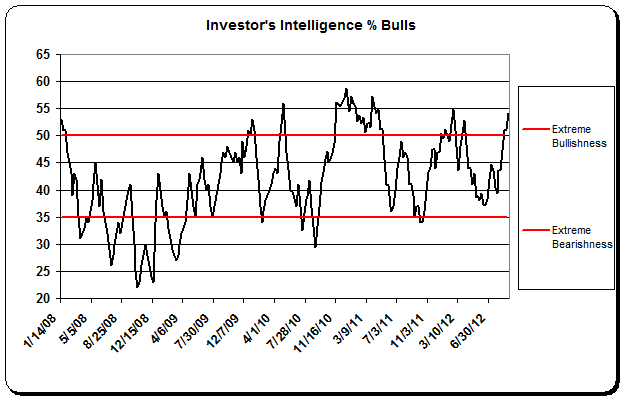

The latest reading from the Investor’s Intelligence Survey of Advisors showed very high levels of bullishness that is consistent with excessive optimism. The new highs in the markets and the Bernanke Put has led to readings in what II calls their “danger area”:

“The new highs contributed to more bulls, to 54.2%, from 51.1% a week ago. Their number is up from 39.4% at the end of July, and the third straight reading above 50%, just in the danger area. It also ended just below the 55% level that starts to get scary. Sometimes that number reaches 60% and significant declines nearly always follow. We now note the most bulls since last Feb, when they hit 54.8% as the Dow neared 13,000. Markets held near that area for about six weeks with the bulls mostly above 50%. Then their number fell quickly to 34% in early June when the averages traded down to their 2012 lows. “

As a result, fewer Advisors believe there can be a correction now:

“For another week there were fewer advisors calling for a correction. They came in at 21.3%, from 23.4% a week ago. Their number continues to drop as the advisors are now taking a stand. The reading is substantially lower from two highs shown earlier this year. They were 39.4% on 1-Jun, when markets were at lows, and 40.9% to begin May when indexes were near highs. Both times, many advisors were uncertain and looking for the opposite direction. If the indexes add to their recent gains we expect to see more bullish shifts, which will ultimately signal danger if the trend persists.”

Here’s the historical view:

Source: II

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.