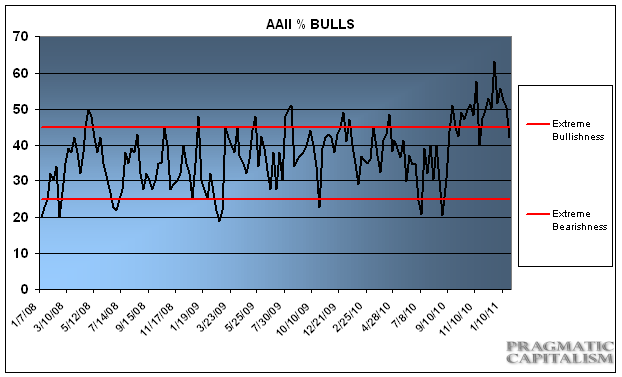

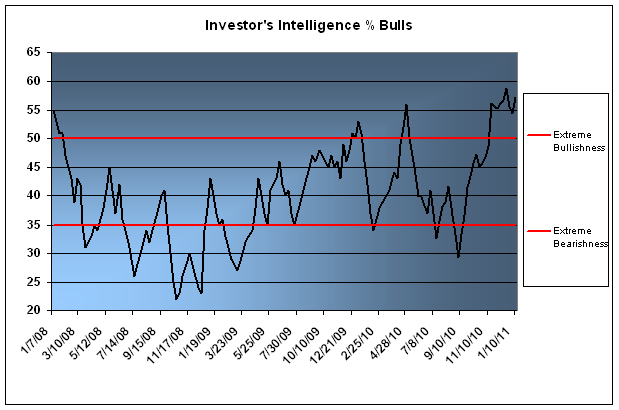

This week’s sentiment surveys showed declines from recent highs, however, remained above historical averages. The Investor’s Intelligence survey said bullishness declined marginally to 55.5% while the AAII sentiment survey showed a larger decline to 42%. Charles Rotblut from AAII elaborated on the report:

“Bullish sentiment fell to a 10-week low in the latest AAII Sentiment Survey. Expectations that stock prices will rise over the next six months fell 8.7 percentage points to 42.0%. Despite the decrease, bullish sentiment remains above its historical average for the 21st consecutive week. This is the second longest streak for above-average bullish sentiment since the survey began in 1987.

Neutral sentiment, expectations that stock prices will stay essentially flat over the next six months, rose 3.5 percentage points to 23.7%. Nonetheless, neutral sentiment remains below its historical average of 31% for the 25th consecutive week.

Bearish sentiment, expectations that stock prices will fall over the next six months, rose 5.2 percentage points to 34.3%. This is the highest level of pessimism since September 2, 2010. It is also only the fourth week since then that bearish sentiment has been above its historical average of 30%.

Bearish sentiment has nearly doubled over the past four weeks, from 18.3% on January 6 to 34.3% now. Though this does somewhat reflect a reversion to the mean, it also shows that some investors are becoming less enthusiastic about the short-term direction of the stock market. The length of the rally, the 1% decline in the S&P 500 last Wednesday (January 19), and the level of optimism signaled by the various sentiment surveys–including ours—are all contributing factors.

It is important to note, however, that bullish sentiment continues to stay above its historical average. The current 21-week streak of above-average bullish sentiment is the second longest such streak in the survey’s history.”

Figure 1

Figure 2

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.