There’s a lot of speculation about the recent rise in interest rates. Rightfully so. But what I find so interesting about the move is the obsession around “tapering” and QE. Of course, I don’t think QE has had much of an impact on the real economy, but that’s not really important here. What is important is that the market is reacting strongly to the policy changes.

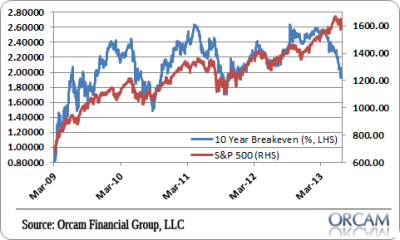

But think really hard about all of this. Here we have an environment in which inflation is running well below the Fed’s target rate at 1.7%, the economy continues to operate well below capacity, unemployment remains high by any measure and inflation expectations are actually cratering (see figure 1). And yet bond traders think the Fed is on the verge of a new tightening cycle?

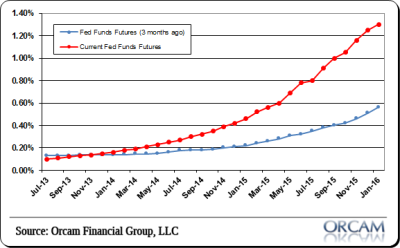

If you look at the enormous change in the Fed Funds Curve (see figure 2) you can see exactly how pronounced this change has been. Traders have shifted their expectations for a rate hike forward by almost a full year over the last 3 months. That’s a phenomenal move.

Something doesn’t add up there though. We either have low inflation, a weak economy and an easy Fed or we have a really strong economy, high inflation and a tightening Fed. You tell me which one we have and whether this doesn’t look like a case of bond markets overreacting to the “taper talk”….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.