There’s a tendency for the wealthy to be conservatives and “hard money” advocates. More generally, it is often assumed that a “big government” takes from the rich to give to the poor. So, it would make sense to assume that the wealthy are the ones most hurt by a bigger government. But is this really true? I don’t necessarily think so. For instance:

1. Wealth inequality in China, a country that can certainly be thought of as being a “big government” system, is among the highest in the world and rising faster than almost any other country on the planet according to Bloomberg. Their state run form of capitalism certainly isn’t trickling down or spreading evenly across the population. So this would seem to contradict the view that a “big government” system necessarily leads to equality.

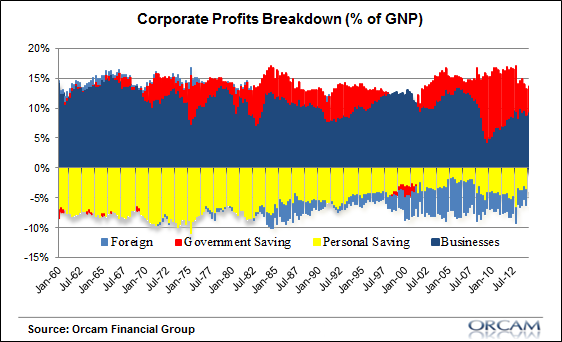

2. We know, from a decomposition of the Kalecki profits equation, that:

Profits = Investment – Household Savings – Government Savings – Foreign Savings + Dividends

From that, we can break-down the situation in the USA and conclude that the government’s deficits were one of the key drivers of corporate profits in the last 5 years:

Since corporate profits are one of the main drivers of stock prices and the net worth of all individuals (particularly the wealthy) then we know that “big government” has actually helped the wealthy to a disproportionate degree in the last 5 years.

3. What about the Fed? The Fed is often portrayed as an entity keeping interest rates “artificially low” thereby taking the interest income that so many wealthy people enjoy from their substantial fixed income portfolios. But what if stock prices and bond prices have been bolstered in recent years by Fed policy? Bonds, on average, have compounded at 6% per year since 2008 while stocks have compounded at over 20% per year since the market low. The wealthy, who hold most of these assets, have benefited from the “manipulation” more than anyone.

These “soft money” policies, including QE, “interest rate manipulation” and massive government deficits, aren’t the types of the policies the rich should dislike. The rich shouldn’t just thank the government for much of what’s occurred in the last 5 years. They should be begging for more of it.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

tealeaves

I think a capitalist would argue on principle that the central bank through low interest rates and government interventions has kept weak companies solvent which arguably drives down the returns of the strongest and healthiest company (ie. GM vs Ford). Ford is doing well today, though perhaps Ford shareholders would have preferred to have GM fail in the private market and then pick up GM’s market share or possibly their assets and restructure that company.

The interventions have provided benefits in terms of equity returns to shareholders but there maybe some unintended consequences of misallocation of assets in the forms of buybacks, M&A and dividends payouts with higher leverage corporate debt. In principle, this idealism of capitalism makes sense though I’m not sure ethically, the right or better answer was liquidation and mass layoff at GM and other weak/impaired companies. And had government/central banks gone down that free market path, who knows if Ford would have seen the kind of shareholder return it has generated because it has likely benefited in some ways by the improving economy.

Using exaggerrated hyperbole, the current system is one where the government has set a precedence that it will bail out to big to fail companies during future downturns and has shifted risk from the shareholders to the citizens. And Fed is propping up basket case companies with cheap credit instead of facilitating an orderly cleansing of the system.

Frederick

QE is trickle down by another name.

John Daschbach

Of course the question of if the Fed has “manipulated” rates lower seems wrong based upon the data and an understanding of markets and the monetary system. As I’ve noted before, if you showed the data series for market yields along with Fed activities, unemployment, and inflation, to 100 scientists who didn’t know what the data was, probably 98 would speculate that QE has a slight impact on yields but that turning off QE has correlated with a significant drop in yields. Look at the 10 yr Tsy: Post-crisis to QE1 it dropped 80 basis points, after QE1 to start of QE2 it dropped 60 bp, and after QE2 to start of QE3 it dropped 140 bp. During QE1 it rose 50 bp, QE2 60 bp, and is currently about 60 bp higher than at the start of QE3.

It seems that people who argue that the Fed has “manipulated” yields lower are engaging in a form of irrational thinking. The facts are easily established, and the data are the opposite of what they argue. Since we can’t do the experiment to see what rates would be without QE we will never know. But when your 6 for 6 in favor of QE raising, not lowering, rates it is hard to rationally argue the opposite.

Shervin

You do know the markets moved BEFORE the Fed announced its QE policies? Or put another way, the markets anticipated the Fed purchasing bonds and yields fell. It’s similar to the situation in Europe with the market anticipating some form of ECB QE or easing.

Comparing what happened post-announcement and drawing conclusions is very flawed.

Suvy

Yea, so what? Every time QE was announced, yields went higher and stayed elevated until the programs were discontinued. If QE actually is stimulative, then long end rates should go higher. Remember that the growth rate of real assets is equivalent to NGDP growth, so any sort of divergence between the 10 year and NGDP growth expectations allow an arbitrage opportunity (short 10 year and long real assets or vice versa). In other words, the spread between NGDP growth and long term yields represents a risk spread.

Suvy

It’s just a massive liquidity expansion and effectively a currency war. The point of QE was to create capital outflows into other countries–primarily emerging markets. QE restricts the amount of securities held by the private sector while the private sector holds more cash. In essence, the point of QE is to create a huge pile of cash for the private sector to hold while removing bonds from circulation. All QE does is change the liquidity profile of the private sector by changing the amount of cash/securities held.

Suvy

I talk about the impacts of QE here. You may wanna take a look at this. Tell me what you think.

https://suvysthoughts.blogspot.com/2014/08/impact-of-qe.html

connie hawkins

it really depends. soft money policies benefit the well connected the most, like bankers. however, soft money policies creat bubbles that eventually destroy wealth. meanwhile,inflation hurts the poor the most.

Guest

I’m really having trouble with the Kalecki profit chart. I hope you can see this. It seems to me that the QE does nothing for “profits” but does eat up some deficit spending, putting this amount on the Fed’s balance sheet. In 2013 the investment and reinvestment of profits and importantly bank credit creation is growing and deficit spending is easing. Can you explain for me what is actually meant by the colors?