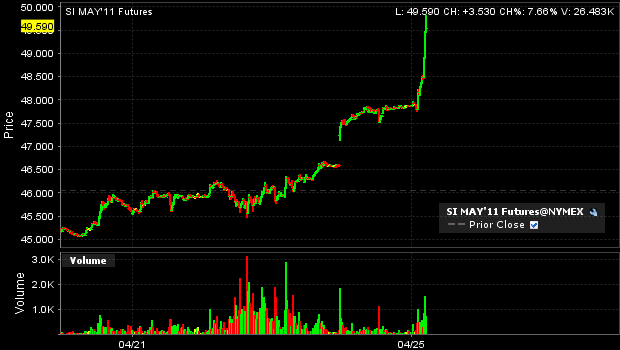

This is why you don’t mess with bubbles to any extent that they can substantially alter your financial well-being. Last Thursday I placed a meager short position via OTM puts on silver. Just three days later those puts are looking more than worthless. Bubbles are not to be messed with in any real size. My bet was placed with the full understanding that it was a bet on black and nothing more. If it hit it would be be a decent winner, but if it lost I’d be fine walking away from the table to fight another day.

Bubbles are extremely unstable and unpredictable environments. Anyone playing in the silver pool must recognize that they are not making a prudent bet in either direction. They are merely gambling. That said, congratulations to anyone who has owned silver for a substantial period of time. It’s been one heck of a ride up. And in my opinion the rollercoaster is starting to look at little shaky as it goes parabolic….

* Mr. Roche is short silver via OTM puts and long silver via mutual funds held in retirement accounts.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.