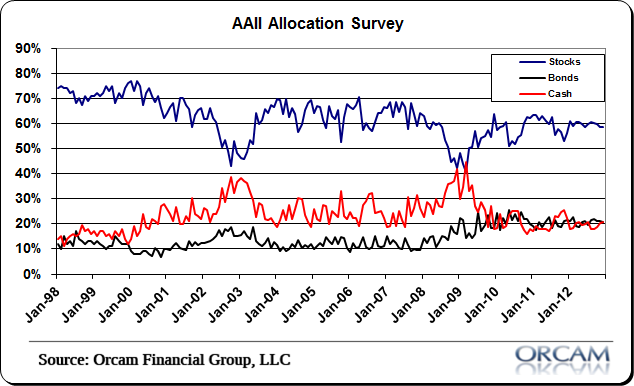

Nothing earth shattering in this month’s AAII allocation report, but there was a small downside shift in equity allocation. We’re still well below the highest levels seen in the last 15 years. Here’s more via the AAII:

Asset allocation was basically unchanged from last month, as many investors stood pat in the face of the end of the year and the possible fiscal cliff, according to the latest AAII Asset Allocation Survey.

Stock and stock fund allocations were unchanged at 58.6%, which is the lowest allocation to equity investment since December 2011. This ended a three-month trend of members reducing their exposure to stocks and stock funds. The historical average is 60%.

Bond and bond fund allocations declined 0.4 percentage points to 20.8%. This is a five-month low for fixed-income allocations. However, December marked the 42nd consecutive month that fixed-income allocations were above their historical average of 16%.

Cash allocations rose 0.4 percentage points to 20.6%. This is the largest percentage allocated to cash since July 2012. Even with the increase, however, cash allocations were below their historical average of 24% for the 13th consecutive month.

Uncertainty with the impending fiscal cliff weighed on investor optimism regarding the short-term direction of the market. After spending the entire month above its historical average, positive sentiment dipped below the long-term average to ring in the new year. Last month saw AAII members pare their stock holdings in favor of cash, so it may very well be the case that year-end adjustments had already been made. However, an argument can also be made that investors were waiting to see what tax agreements were reached between Congress and the president and what their impact would be on the market.

December’s special question asked AAII members what year-end changes, if any, they were making to their portfolios and why. The majority (57%) were making some changes to their portfolio, while 43% were making no changes. Among all respondents, 17% were adjusting their portfolios due to tax considerations; 10% were adding equity; 9% were reducing equity; 9% were performing standard rebalancing; 9% were buying dear and selling rich; 1% were adding bonds; and 1% were prepared for the end of the world. (The question is whether they are happy or disappointed with the outcome!)

Here is a sampling of the responses:

- “Going to cash before the Mayan prediction of the world’s end comes to pass via our legislators in Washington.”

- “Prepping. The world is going to end!”

- “My decisions will depend heavily on what happens in Congress with respect to the fiscal cliff.”

- “Will make no changes until Congress gets its act together.”

- “None. Like to move more in bonds but feel the only way the bond market can go is down.”

- “None. I’m a long-term, hands off investor. I make my once-a-year balancing adjustments in the spring; I do not make investment decisions based on tax implications.”

- “Accelerated trimming of some big winners in anticipation of capital gains tax increase in 2013.”

- “Taking more long-term gains to avoid getting screwed by Obama and his class confiscation.”

- “On sidelines due to fiscal cliff.”

- “Possibly moving more money to cash or to more defensive stocks due to uncertainty of political landscape.”

- “Lowering allocation to stocks until fiscal cliff is resolved.”

- “Increasing equity content, as I believe that bonds have entered bubble territory, and inflation may rise.”

- “Increasing my stock allocation to the “AAII Shadow Stock Portfolio” screen.”

- “Getting the mix back to my target asset allocation.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.