Anyone who remembers the 2008 election remembers how important the economy and the stock market were in deciding the outcome. It looks like a similar trend is developing in the 2012 election.

Personally, I am shocked that Obama even has a prayer in this election given the unemployment rate. I said back in 2009 that the unemployment rate was likely to be over 8% when he was running for re-election and that that would bury his chances. But boy was I wrong about that. According to Intrade the President is still the odds on favorite to win the upcoming election at 58%.

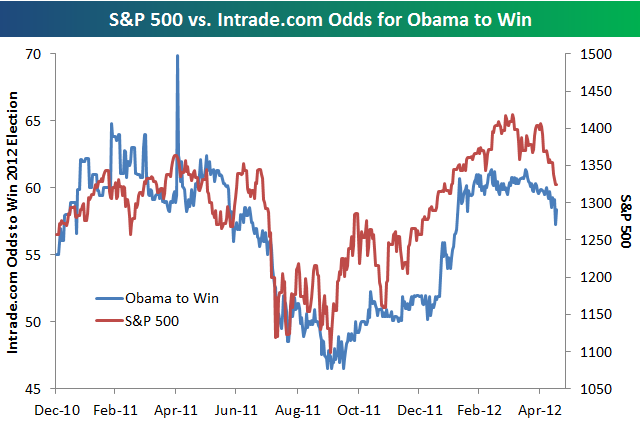

But the stock market could change all of that in a heart beat. I was struck by the chart below showing the Intrade odds of an Obama win versus the S&P 500. In this “what have you done for me lately world” it seems that the latest stock quote is one of the primary drivers of the well-being of the country and a real-time reflection of the President’s efficacy. Obviously, this isn’t an entirely rational view of the world and stock prices don’t always reflect our reality, but the data doesn’t lie….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.