Hedge funds are now allowed to advertise to the general public and boy are they going to need it. Recent data not only shows abysmal performance, but increasing mutual fund-like characteristics (which is usually a bad thing). Jacob Wolinsky of Value Walk recently cited a Morgan Stanley report discussing some trends in the hedge fund industry:

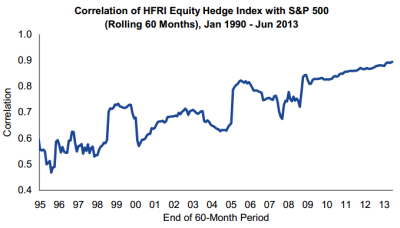

“In terms of correlation, the S&P 500 correlation with the HFRI Equity Hedge Index is moving up. Basically,investors are paying 2/20 to buy a closet index fund. As Parker puts it (in a much more eloquent fashion) ‘Hedge Funds in Aggregate Are Essentially Long the S&P 500′. See the chart below.”

It’s not terribly surprising that the correlations have increased as the industry has grown and macro trends have dominated, but it is surprising to see the correlations this high. Jacob is precisely right. If you own a hedge fund these days there’s a VERY highly probability that you’re getting gutted on fees to do what an index fund could do.

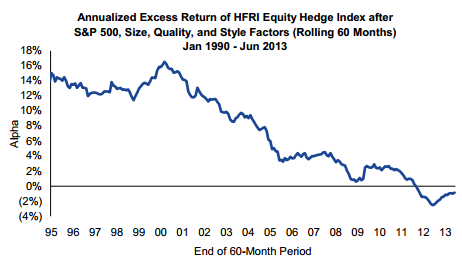

The performance data only makes it look worse. As you can see below, the growth of the industry has also coincided with reduced alpha generation. And someone please correct me if I am wrong, but the HFRI doesn’t even account for survivorship bias, which, if included here would likely make this trend look much worse.

I hate to be so general about this when there are clearly some funds that are probably worth owning for various reasons, but it’s kind of amazing that the 2 & 20 fee structure has lasted this long. At this rate the fee structure of the hedge fund industry is beginning to look a lot like a legalized scam. And now that scam is going to be sold to every mom and pop in the mainstream media when hedge funds unleash their vast coffers (ahem, the fees you paid into them in the first place) to convince more people to buy into them….Some people would call that sort of arrangement a ponzi scheme….

* And just in case anyone is curious, yes, I’ve looked at the risk adjusted numbers and they show similar 10 year trends. The HFRX has returned just 2.24% per year with a standard deviation of 11% while bonds have generated 5.76% at 8.6% standard deviation while stocks have generated a 8.8% return at 18.3% standard deviation. Now, I didn’t run Sortino ratios and volatility is hardly a comprehensive measure of risk, but the numbers validate the trends above. As the sample set grows the hedge fund world is starting to show all the same trends of underperformance that are seen in the majority of mutual funds…..

See also:

A Disturbing Trend I see in Hedge Fund Returns

Hedge Funds Are Getting Their Teeth Kicked in this Year

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.