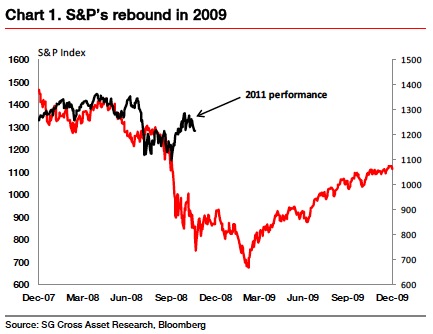

I’ve been having this same thought in recent weeks although markets will never perfectly mirror past markets. Given the high level of fear and the persistent Euro crisis, it doesn’t seem unreasonable that we could experience an extremely volatile and traumatic Q1 2012 ultimately leading to a panic low and a pretty decent rally thereafter. The fear levels in the market currently are eerily similar to 2008 when nearly everyone thought the world was ending. It’s clear that the Europeans can’t act on their problems until they’ve smacked them in the face. So, just like 2009, it might take a waterfall decline to force politicians into action. I’m not making any predictions (I don’t believe anyone can accurately predict market action more than a quarter in advance), but the SocGen note makes sense (via Business Insider):

“Next year is likely to present a similar profile to that of 2009, in our view, with an initial of severe weakness in the short term, followed by a healthy rally. The magnitude of the market moves may however be less significant than in 2008-09, however, on both sides. First, it looks for now that the peak-to-trough correction in risky assets may be less violent that three years ago, which also suggests that the recovery in global markets may also be less pronounced.

We are bullish on emerging markets in 2012, but only after the global backdrop has improved markedly, including on the front of the EU sovereign debt crisis. This means that we will likely have to wait until after the first quarter next year to see a strong recovery in appetite towards emerging markets. In the near term, the major market focus will remain on the severe market tensions, with the risk of an escalation of global financial stress. Against this backdrop, we retain a bearish view on EM for the next few months, before standing ready to be positioned for a broad-based recovery.”

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.