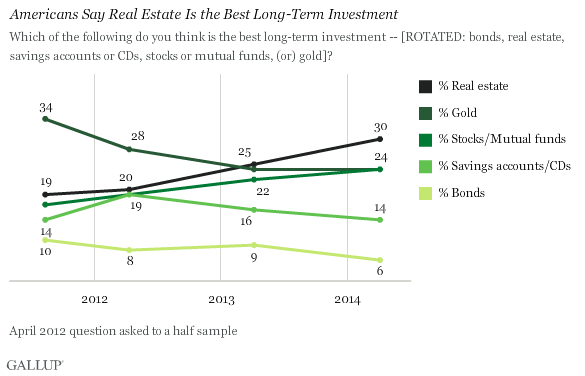

This recent Gallup survey on expected future returns of asset prices is pretty interesting. It shows that most Americans still think that owning a home is the best way to generate a high return in the future:

Look at those figures. The top two assets are gold and real estate. This shows how out of touch with reality the average American is. According to the U.S. Census Bureau Survey of Construction single family real estate generates a 0.74% annual return over the last 30 years (this includes multiple housing booms, mind you, so the data is probably much lower if we go further back in time). So there appears to be some recency bias here despite the housing bust.

And this doesn’t even account for many of the miscellaneous costs involved in real estate. As I’ve shown previously, a house is basically a depreciating asset that comes with an appreciating piece of land. But that depreciating asset is extremely expensive over its lifetime. When you calculate the total costs that go into maintaining this asset the returns are very likely to be negative over long periods of time. So that 0.74% figure is probably higher than you should really expect. In fact, the returns from stocks and bonds trump real estate by a healthy margin so Americans have this one totally backwards – the American Dream isn’t quite the dream we have been sold.

Gold is more interesting. Gold is a commodity that is widely perceived as a currency. If you look at the long-term returns of gold in the post-Bretton Woods era the real returns are pretty substantial at 7.8%. That’s not much below stocks at 8.4%, but substantially higher than T-bonds at 3.2% and higher than the aggregate bond index at 5.4%. This is interesting when you consider that gold is really just a commodity and commodities don’t tend to generate real returns over the long-term. I’ve surmised that gold has a “faith put” in its price due to the currency belief. Whether that can last over the long-term is dubious in my view. So I wouldn’t be surprised if that view turns out to be wrong as well….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.