It’s become extremely fashionable in recent weeks and months for analysts and economists to propose cutting the Interest On Excess Reserves based on the assumption that this will suddenly stimulate lending and help the Fed gain some traction on the policy front. Some economists seem to think that paying interest on excess reserves is keeping banks from “lending out” their reserves. This is extremely misleading in my opinion and often times based on a total misunderstanding of how modern banking works (see here for instance).

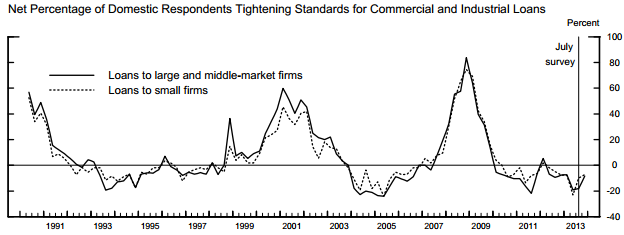

First of all, banks have eased lending standards substantially. The latest Senior Loan Officer Opinion Survey on Bank Lending Practices showed that lending standards have eased considerably in recent years:

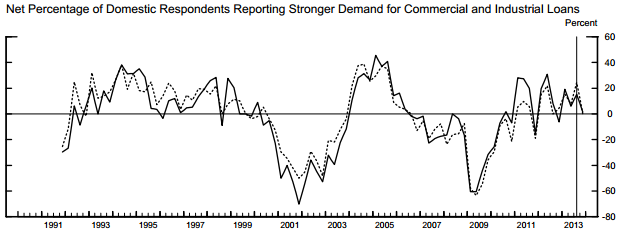

Okay, so if banks are flush with reserves, as profitable as ever and lending standards are low then what could be the problem? Well, it must be a demand side problem then. And the data confirms this. The latest survey shows that demand for loans is still relatively weak:

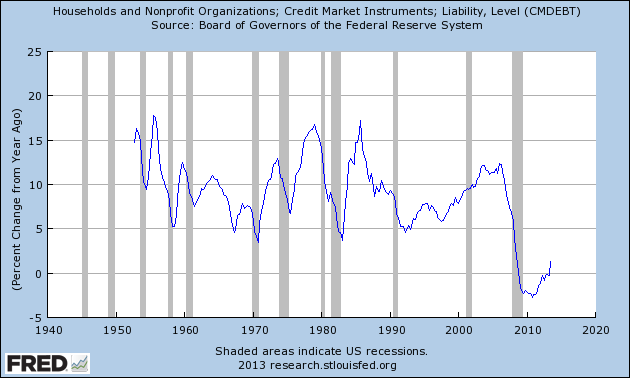

This makes sense considering that households only JUST reported their first year over year increase in debt accumulation in the last 5 years:

The lack of lending and increase in the broad money supply from loan creation is the direct result of a lack of demand. It is not the result of supply side issues. Reducing the IOER is not going to increase demand for loans. You can’t fix a demand side problem of this type with supply side fixes so please, let’s stop with this “reduce the IOER” madness.

Related:

Understanding the Modern Monetary System

The Money Multiplier is a Myth

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.