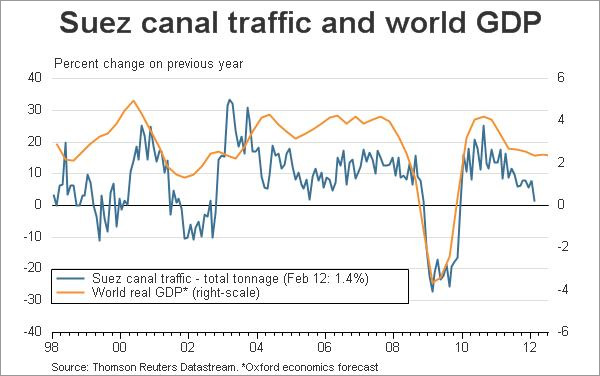

Here’s an indicator I had never seen before. Reuters is highlighting the slow-down in Suez Canal traffic as a possible harbinger of stagnating global economic growth:

“As this week’s Chart of the Week indicates, traffic through the Suez Canal in Egypt – a key cargo transportation route – has nosedived in recent weeks and months. Currently, Suez traffic is only slightly better than flat compared to year earlier levels. Unsurprisingly, perhaps, the trends in global GDP growth tend to mirror those in traffic transiting the Suez canal; it is logical that trade volumes would flag during periods of contraction or sluggish growth, as is most vividly illustrated by the close correlation between the two indicators at the height of the financial crisis from late 2008 through 2009.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.