I usually hate historical comparisons but every once in a while a time comes along where there are just too many similarities to ignore. And right now looks a lot like one of those times. The 1998 Asian Currency Crisis is looking all too familiar here. We had a bunch of countries with pegged currencies who were experiencing trade imbalances, foreign denominated debt crises, ultimately leading to economic slowdown, foreign currency turmoil, commodity turmoil and economic turmoil.

2015 is a little different because you don’t have so many countries with foreign currency pegs. In addition, the foreign currency reserve position is far healthier. But you have one big wild card here which makes up for all of that – China and their pseudo peg. In 1998 you had a rolling crisis of sorts where lots of little problems (emerging market debt scares) eventually boiled over into one bigger problem (the Russian default) and then appeared to be rolling over into foreign markets with the LTCM debacle. It didn’t of course because emerging markets aren’t the tail that wags the global economic dog.

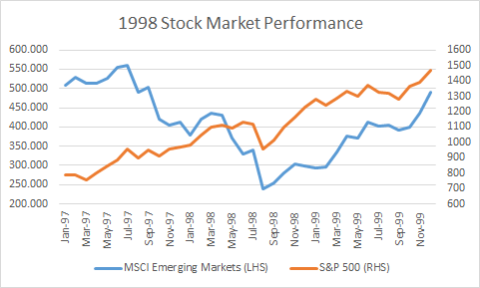

That all sounds too familiar today. And here we are in year 3 or 4 of a rolling emerging market slowdown which now appears to be culminating in cratering emerging market stock markets and spillover into the developed world economies. Now, I personally find it hard to believe that a country that makes up just 5% of S&P revenues like China does, is going to derail the US economy, but I would be an idiot if I didn’t admit that I have no idea what’s really going on in the Chinese economy (and neither does anyone else to be honest). But common sense tells me that this isn’t a 2008 repeat. Rather, it’s much closer to a 1998 repeat where emerging market stocks got crushed and then whipped back while US stocks fell about 18% and then roared to much higher highs.

History doesn’t repeat, but this one sure looks like it rhymes….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.