For the better part of 5 years now we’ve heard repeated predictions for hyperinflation, US Dollar collapse, economic collapse, bond market collapse, stock market collapse, etc. All of these predictions were wrong. And they all started with the same general ideas – the Federal Reserve system is a scam, the US government is “printing money”, government debt will be the end of the USA, etc. All of this stuff has been wrong. And not just a little bit wrong. It’s been devastatingly wrong. There has been nothing close to hyperinflation. There has been nothing close to a bond market collapse. There has been nothing close to a dollar collapse.

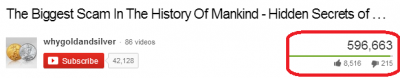

For some reason these people continue to garner all the praise and attention. For instance, just look at this video I posted over the weekend and how many likes vs dislikes it has. 8500 likes vs 200 dislikes!!!! That means 98% of the people who watched this video thought it was good.

I don’t understand this. And I have to admit, after having been debunking these sorts of predictions for the better part of the last 4-5 years, I feel pretty discouraged by the progress (or lack thereof) since the crisis. It appears as though the only thing that’s been learned since the crisis is that fear sells and people seem to really like to buy into it. Even when it’s pure unadulterated poppycock.

NB – And don’t get me wrong. There’s nothing wrong with being wrong. I embrace being wrong. That’s a big part of how we learn. But being wrong for 5 years straight with nothing learned and just the same regurgitated wrong message time and time and time again? At what point do we start to wonder why these people have been wrong? Better yet, at what point do we start to say, “how can we learn from what they got wrong?”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.