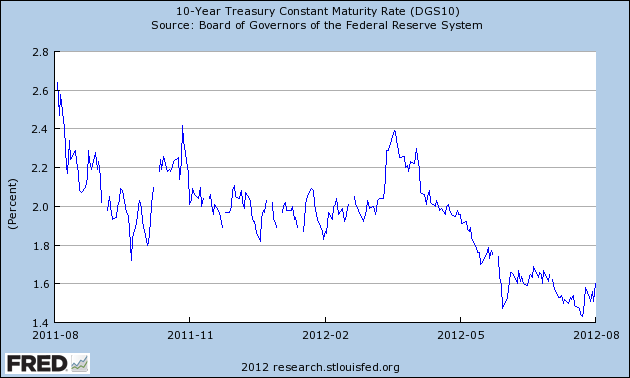

It’s now been one year since Standard and Poors downgraded the debt of the USA from AAA to AA+. If you recall, many pundits were saying this would be an earth shattering event and that it was a sign of much bigger problems to come. Some even said it could cause a Eurostyle debt spiral in the USA where bond vigilantes attack and yields surge causing a funding crisis and even a potential default. But what’s actually happened? As you can see in figure 1 below yields have actually continued to move substantially lower. In fact, yields are a full 1% lower than the 2.6% yield that we saw before the downgrade. In other words, the downgrade has had zero impact.

Some might still be wondering why this is? The reason is simple. There is no risk of the USA having a funding crisis since it can always procure funds via taxes and bond sales. That’s right, the government has no solvency risk. It has only an inflation risk. As I recently described:

“The USA has an institutional arrangement in which it is a currency issuer. That is, while the Treasury is an operational currency user (meaning it must always have funds in its account at the Fed before it can spend those funds) it is always able to harness the banks to procure funds. This is achieved through bond auctions in which the dealers are required to bid. The NY Fed explains:

Primary dealers are also required to participate in all auctions of U.S. government debt and to make reasonable markets for the New York Fed when it transacts on behalf of its foreign official account-holders.

So there’s never a concern about auctions failing in the USA. That is, the Treasury is a currency user, but the government as a whole can be seen as a currency issuer by institutional design because of this implicit funding guarantee. “

But don’t take it from me. Take it from the bond traders themselves who clearly view US Treasury bonds as being among the safest assets on the entire planet….Sadly, Wall Street seems to have learned from this and they continue to snatch up bonds clipping coupons and reaping the benefits. Meanwhile, the rest of us are forced to listen endlessly about how the government is on the verge of its Greek moment so we perpetually worry about “paying off the national debt” as opposed to understanding the actual operational realities of our monetary system, the effects of the balance sheet recession and how we are monumentally wasting one of our most powerful economic tools – the very government we designed….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.