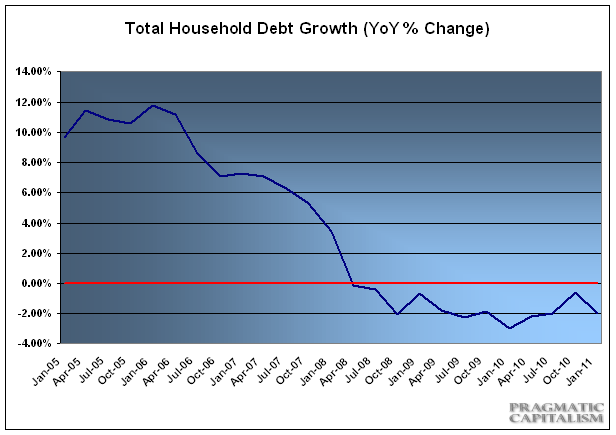

This may very well be the most important data point that we are currently receiving every quarter. Yesterday’s Z1 released by the Federal Reserve showed a continuing decline in household credit. The latest reading showed a -2% decline in total household debt growth versus last year. The Fed summarized the data:

“Household debt declined at an annual rate of 2 percent in the first quarter; it has contracted in each quarter since the first quarter of 2008. Home mortgage debt fell at an annual rate of 3½ percent in the first quarter, ¾ percentage point more than the decline posted last year. Consumer credit rose 2½ percent at an annual rate in the first quarter, the second consecutive quarterly increase.”

Total household debt continues to decline

Frustratingly, I’ve been discussing this dynamic for well over 2 years now. In early 2009 I wrote about why this wasn’t the banking crisis that Ben Bernanke thought it was, why the aid package would likely fail to help Main Street (it focused too much on Wall St) and why we were remarkably similar to Japan:

“Unfortunately, our leaders have misdiagnosed our problem as a banking crisis and not a Main Street crisis. We have ignored the real root cause of the problem which lies not with the bank balance sheets, but with the household balance sheets. As I have long maintained, we are looking more and more like Japan and the balance sheet recession they suffered. While we ignore Main Street in favor of Wall Street it’s likely that the recession on Main Street will endure….”

Being a consumer driven economy this decline in debt remains the most important component of our economic plight. As I’ve previously explained, the collapse in consumer debt has been the primary cause of weak economic growth. Consumers took on excessive debt levels during the housing boom and when housing prices collapsed their balance sheets were turned upside down. Consumers were left with excessive debt, collapsing aggregate incomes and a subsequent balance sheet recession. The overall result is that consumers are still working to pay down this debt and remain in saving mode as opposed to debt accumulation and spending mode.

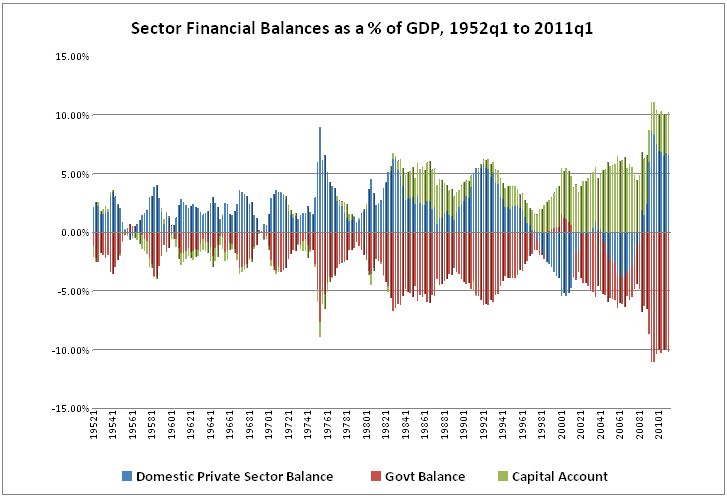

This is a highly unusual event that has only been seen on rare occasion in developed economies over the last 100 years. As this process occurs there is only one entity that can help to stabilize the economy – the US Federal government. As we know from the sectoral balances, when the private sector is in saving mode and not spending mode (due to debt reduction) and the current account remains in deficit, there is only one sector that can offset this weakness in an attempt to create economic growth. That is the public sector. Thus far, we’ve managed to fend off the austerity chatter, however, the risks appear to be on the rise as government officials become convinced that the United States is bankrupt (something that is fundamentally impossible).

This is the exact situation we have seen in Japan for the last 20 years and it is currently occurring in much of Europe. If the United States implements a policy of austerity there is little doubt that the economy would continue to contract again, unemployment would increase and the economic malaise would worsen. By my estimates, this situation is likely to persist well into 2012 and perhaps longer depending on how the economic environment progresses.

—————————————————————————

* Addendum 1 – It’s important to note that the consumer debt reduction process is a good development. It is necessary to help build the foundation for a sustainable recovery. Consumer debt accumulation in moderate levels should been seen as a good thing. Unfortunately, it was the excessive debt binge that caused our current predicament. As this process heals over the years we should embrace it and accept it as a necessary part of the natural economic progression following a debt bubble. That requires a unique policy response and a particularly important need to focus on Main Street’s woes and not Wall Street’s woes.

** Addendum 2 – Because monetary policy works largely to increase the debt levels and by helping the banking sector, it can actually be detrimental to this natural healing process during a balance sheet recession. This is why we should reject further Fed intervention in the markets and encourage Congress to look into potential aid packages such as a reduction in taxes.

*** Addendum 3 – Scott Fullwiler wrote a spectacular piece on sectoral balances here. This should really help clarify what is going on today. Scott Fullwiler for Treasury Secretary?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.