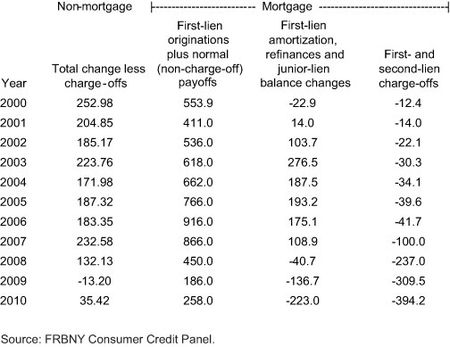

Contrary to reports that consumers are only being forced to pay down debts, the NY Fed offers their own evidence showing that consumers aren’t merely being forced to pay down debt, but are choosing to pay down debt:

“So, U.S. consumers have been deleveraging. Holding aside defaults, they have indeed been reducing their debts at a pace not seen over the last ten years. A remaining issue is whether this deleveraging is a result of borrowers being forced to pay down debt as credit standards tightened, or a more voluntary change in saving behavior. There is evidence on both sides of this question. For example, the Fed’s Senior Loan Officer Opinion Survey indicates that credit standards were tight through much of 2007-10. On the other hand, the reduction in housing and stock values over the same period may have led families to want to reduce their debts, in an effort to restore their net worth. We hope to discuss these questions in more detail in later posts. Meanwhile, we will continue to post updates of household credit conditions on our website.”

Consumers have recognized that they have an unsustainable problem. For now, de-leveraging continues to be the right path for the US economy (despite the Fed’s wishes of re-leveraging). As I’ve previously discussed, this balance sheet recession is likely to continue well into 2013, assuming that de-leveraging actually continues. If consumers re-leverage this will only add to the unsustainable environment that surfaced during the housing bubble. This all means the economy remains incredibly unstable. These levels of leverage are simply not sustainable and still pose the largest risk to the economy. For now, deficit spending is offsetting the impact of the de-leveraging and is helping to sustain marginal economic recovery.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.