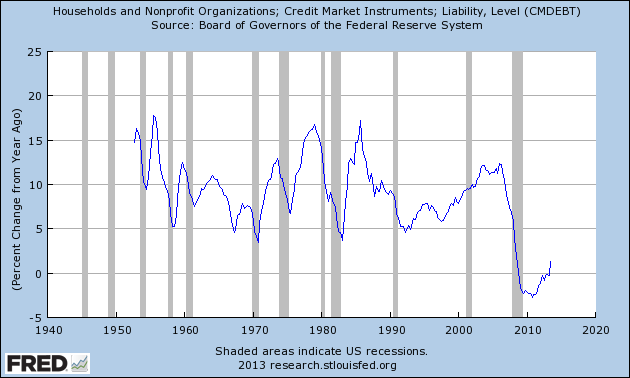

I am glad (and sad) to say that the Balance Sheet Recession in the USA appears to be over. Yesterday’s Z.1 report from the Fed confirmed that households have indeed begun releveraging. Household debt showed its first year over year gains (on a quarterly basis) in Q3 since the crisis began. The end of the BSR arrived just about on time. Several years ago I predicted that the Balance Sheet Recession would likely end sometime in 2013 or so.

This is a good sign. But we’re by no means back to levels where we were. On the other hand, growth is growth. The economy rarely grows without private sector debt accumulation so this is a sign that balance sheets are normalizing. It’s also a sign that the tapering can begin without worry of imploding the markets. The private sector is really starting to run with the baton here so we shouldn’t be terrified of the government stepping back some of its extraordinary measures here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.