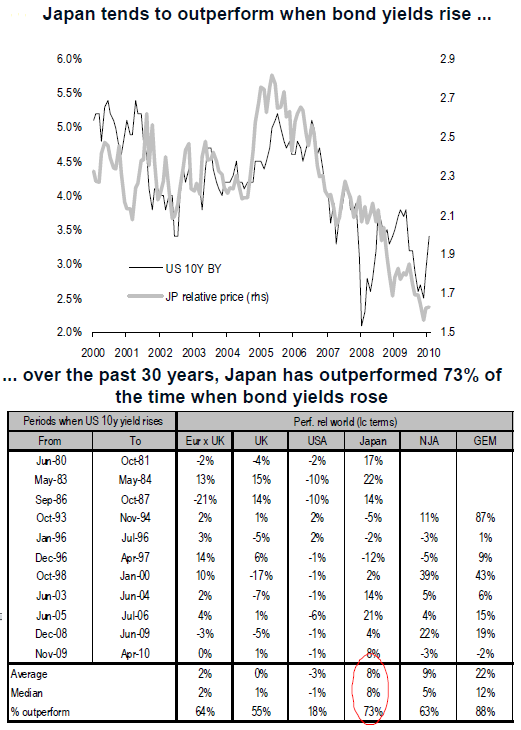

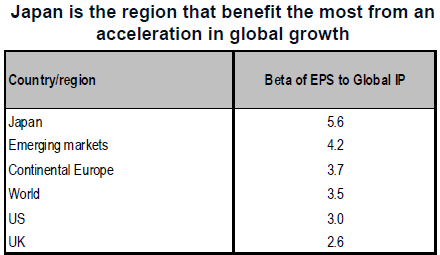

In a recent strategy note Credit Suisse analysts noted the risk of rising interest rates and the potential beneficiaries in such an environment. In their opinion the #1 trade in a rising interest rate environment is not an inflation or hyperinflation hedge, but rather a high beta growth equity market – Japan. Based on data compiled by Credit Suisse they’ve found a near 1:1 correlation between Japanese equities and US interest rates over the last decade. The rational is rather simple – because rising rates tend to be accompanied by periods of higher growth Japan’s volatile high beta market tends to be a significant beneficiary. In addition, after years of deleveraging rising interest rates put less pressure on Japan’s underleveraged corporations and are likely to pressure on the Yen via an increasing dollar (via Credit Suisse):

From a regional point of view, the winner of rising bond yields is Japan: (i) historically it outperforms 73% of the time (by an average of 8%) when US bond yields rise. In particular, the rise in real bond yield reflects a rise in growth expectations – and Japan, as the country with highest operational leverage, should benefit from such a rise. (ii) Japan’s corporate sector is very underleveraged. (iii) Higher bond yields should put downward pressures on the Yen.

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.