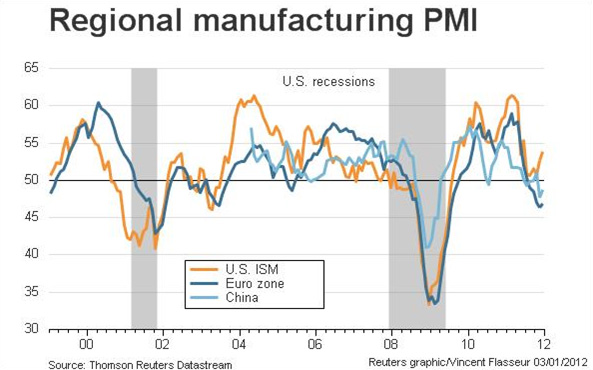

It’s way too early to pop the champagne here, but the latest PMI’s from the big three regions (China, USA and Europe) all showed signs of improvement. The recession story is on the back burner in the USA as 10% budget deficits continue to fuel steady, but low growth in the world’s largest economy (via Thomson Reuters):

“While economists still fret about the European economic woes spilling over into the U.S. and creating tailwinds for what remains the world’s largest single economy, it is worth noting that the paths of the manufacturing sectors in the United States, Europe and China appear to be diverging. The chart below compares the results of purchasing managers’ indexes for all three regions. With the last handful of ISM readings, the U.S. manufacturing industry appears to be staging a solid if not spectacular upward move, while both the European and Chinese measurements suggest that manufacturing activity in both is contracting rather than expanding.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.