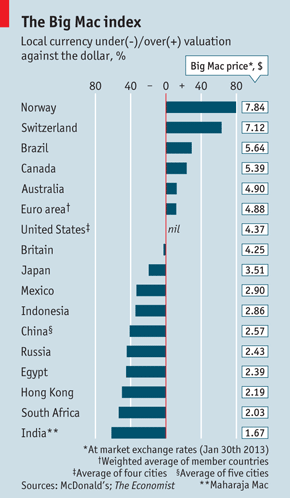

The Economist’s Big Mac Index provides us with a glimpse at relative values in the currency markets. Although it’s not an exact science it does help provide a fairly steady reading on a global product, McDonald’s Big Mac sandwich. According to the latest reading the index is showing substantial overvaluation in Norway and Switzerland:

“At market exchange rates, the Canadian version of the burger costs $5.39, compared with an average price of $4.37 in America. By our reckoning, then, the Canadian dollar is roughly 24% overvalued relative to its American counterpart. In Mexico, by contrast, a Big Mac is just $2.90 at market exchange rates, suggesting the peso is 33% below its long-run value relative to the dollar. The greenback buys much more Big Mac south of the border than north of it.

The Big Mac index suggests that currencies are particularly overvalued in Norway, Switzerland and Brazil (see chart). The continuing strength of the real is a big source of irritation to Brazil’s finance minister, Guido Mantega, who first trumpeted the phrase “currency wars” in 2010. Brazil battled back by introducing capital controls in the form of taxes on foreign purchases of Brazilian securities, but the currency remains overvalued. In December Brazil notched a record current-account deficit as its exports tumbled, contributing to a slide in the economy’s growth prospects. Switzerland handled its overcooked currency by pegging its franc to the euro in 2011. That halted the Swiss franc’s appreciation against the then-beleaguered single currency, although not against the dollar.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.