One thing I’ve really battled with in this industry (and in life) over the years is overcoming emotions. In particular, overcoming fear. If you have a portfolio you’re probably worried about something (to some degree). It’s natural. You’ve accumulated all this savings and you’re worried it might just disappear on a computer screen because of a few bad decisions.

About 5 years ago I began developing strategies that were sophisticated enough that they essentially eliminated this element of emotion. That was a huge break-through for me as it freed me up to focus on other things and stop obsessing over the numbers changing on the computer screen.

I was reminded of this as I reviewed some data and thought about our current reality. There is still a huge bull market in fear. The VIX at 16 (historical lows of 10), low bond yields, consumer confidence, small business sentiment and many other indicators all make this abundantly clear. But the interesting thing is that Americans aren’t alone in this. This is a global bull market in fear.

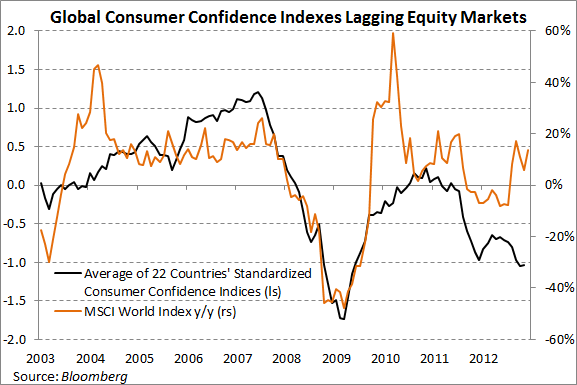

Let’s take a look at some of the data. This chart via Bloomberg Briefs shows global consumer confidence versus the equity indices. What was once a tight correlation has almost completely disappeared in the post-crisis era.

The Orcam Wall of Worry Index, which is a summation of many different sentiment readings, remains elevated and nowhere near the lows of 1990’s.

(Source: Orcam Investment Research)

So, the good news is, you’re not alone if you’re fearful. The bad news is, your fear of everything is probably holding you back to some degree. The trip to the top of the investment mountain is strewn with land mines. But you still have to be willing to put one forward in front of the other to get there. Measured optimists will get to the top first.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.