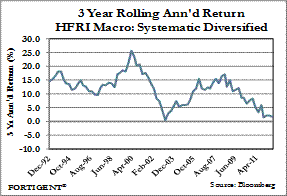

It’s been a rough couple of years for managed futures funds. The HFRX Macro Systematic Diversified CTA Index has been down 3 of the last 4 years (currently down -8% YTD). A run like that in this industry puts you at risk of losing huge amounts of investment flows. But Fortigent argues that the death of managed futures may be greatly exaggerated:

“Over the longer term, managed futures strategies have been a very consistent asset class. Despite encountering pockets of underperformance, the category as a whole has failed to post a negative three-year rolling return based on quarterly data since 1990.The index came close in early 2003, but surged back over the following four years.

While past performance is not a guide to future returns, the asset class does have a powerful long-term track record. Even if one were to assume performance never reached previous levels, however, managed futures’ diversification benefits remain intact. When considered in a broader portfolio context, managed futures can still play an important role in dampening volatility and providing a source of uncorrelated return. And this is in addition to the practical benefits contributed by one of the most liquid investment strategies in the industry.

While time will be the only true test, reports of managed futures’ death may be greatly exaggerated.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.