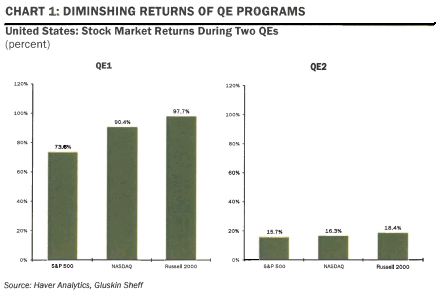

Pretty interesting commentary from David Rosenberg this morning on the diminishing returns of quantitative easing. Like myself, Rosie has noted that QE2 did little to nothing and the equity markets appear to be coming around to the realization that QE is not the savior that so many believe it to be:

It’s not as if QE2 accomplished anything except a blip on the screen as far as the market was concerned, and it elicited no lasting impact for the economy either. QE1 did work but that was when the system needed to be saved – the S&P 500 rallied 74% on that program. QE2 was nothing more than a gimmick shrouded in deflation concerns that never materialized, and during this program the stock market ended up just 16%. And so what will QE3 bring except more in the way of diminishing returns and resource misallocations caused by central bankers attempting to play around with mother nature by manipulating asset prices? Call it the equivalent of the Godfather Trilogy: Godfather I was epic; Godfather II not quite as good but still fine; and Godfather III was a dud.

I agree with just about everything except the comments about Godfather 2 being “not quite as good”…

Source: Gluskin Sheff

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.