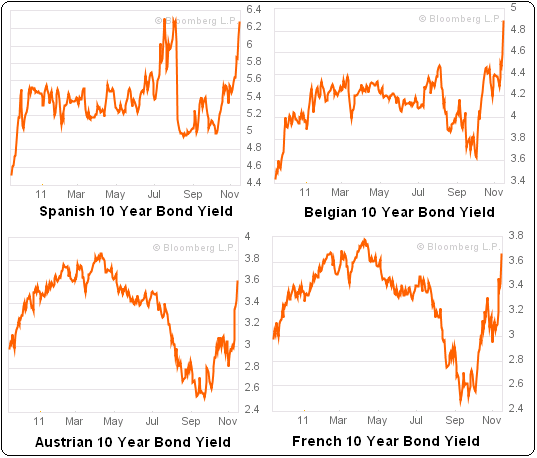

This is getting more interesting with every day. As the ECB is increasingly pressured to stop the Eurozone crisis with massive bond buying, the yield blowout is starting to spread to the core countries. The surge in Italian bond yields is taking all the media glory in recent weeks, but the surge in French, Belgian, Austrian and Spanish yields is equally alarming. Spain’s 10 year yield is now sitting well above 6% with Belgium fast approaching the 5% level.

The concern here is that the problem is now spreading throughout the entire region with the Netherlands and Germany (surprise, surprise, the two largest trade surplus nations who don’t require the same external rebalancing as their trade counterparts) being the only two nations not participating in the broader contagion. This really highlights the crux of the issue here and the trade imbalance at work. Bond markets are selling off the debt of the nations who most need the rebalancing (read, floating exchange rates or fiscal transfers). And we can expect this issue to persist until a real fix has been implemented.

With other nations now increasingly impacted the ECB’s role as bond buyer becomes muddied. There is simply no way they will be permitted to purchase the quantity of bonds that would be required to contain all of these countries. The Germans will view it as the ECB monetizing the entire region. Clearly, that’s not going to happen. As Angela Merkel mentioned the other day, greater political unity is needed. But they need to go further than that.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.