As the Euro crisis has evolved it’s becoming increasingly popular to compare the EMU to the USA. That is, the states in the USA are analogous to the countries in the EMU in that they are all users of a common currency and are not autonomous in that currency (ie, they can’t issue the currency independently).

And an interesting thing has happened during the financial crisis. Europe’s nations have been roiled by economic weakness just like the US states have been. The US state budget woes are well known and have even been the source of some Wall Street analyst’s dire predictions. But no US state has even come close to experiencing a solvency crisis while several European countries teeter on the edge. The most striking occurrence has been the surging bond yields across Europe.

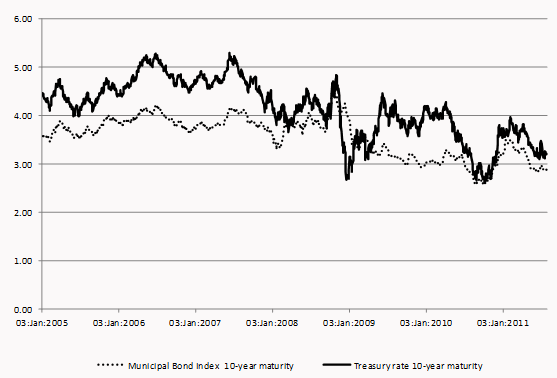

I’ve discussed this in detail over the years and why the analysts crying for mass US state insolvencies were likely to be wrong, but now we have some interesting new analysis via VOX. What’s depicted below is the 10 year US Treasury versus the 10 year muni bond index. As you can see, the yields have an extremely high correlation – muni bonds practically ARE treasury bonds. So why are yields surging in Italy, Spain, Greece and Portugal, but they’re remaining so tame in the muni market? Simple – the US government, which can always procure funds via taxes and bond sales therefore making solvency a non-issue, provides substantial federal aid to the states every year. While this doesn’t eliminate the solvency issue at the state level it certainly helps reduce it substantially. Europe has no such mechanism in place so what you basically have is a bunch of US states in an environment where they’re left to fend for themselves. They can’t print their own currency, they can’t devalue their own currency and they can certainly run out of Euros. The result is bond investors who are terrified about default and end up selling bonds which only exacerbates the budgeting process.*

More below from the paper:

“The housing bust, the financial crisis, and the recession have devastated state and local tax revenues. As a result, the US municipal bond market has experienced worrisome signs of instability. The average rate on municipal bonds at times surpassed the rates on US Treasury securities. In normal times, rates on municipal securities are lower than on US government offerings because of the tax benefits municipals (munis) receive. The now higher borrowing costs for individual US states reflect concerns about their future revenues and pension obligations, among other things. In addition, there is no bankruptcy mechanism governing state defaults, unlike Chapter 9 for municipalities. In other words, US states can repudiate their debt. Under the 11th Amendment to the US Constitution, individual states have the same sovereign immunity as countries, and states can be sued only with their consent.”

* See below for more on why the institutional design of the US monetary system makes it unique compared to Europe:

JKH on the Contingent Insitutional Approach (advanced reading)

Understanding the Modern Monetary System

Monetary Realism’s recommended reading page.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.