In recent weeks some hyperinflationists have succumbed to the reality that QE2 isn’t really adding net new financial assets to the private sector – it is indeed just an asset swap. But this hasn’t stopped them from claiming that QE2 directly results in an exploding money supply. This convoluted thinking claims that QE is directly funding government spending (as if the US government would have stopped spending money and folded up shop without QE2). So now the theory is that QE is really resulting in excess of $1.5T in new money in the form of deficit spending. This is flawed for reasons I have previously explained, but let’s not theorize about the money supply – let’s allow the facts to speak for themselves.

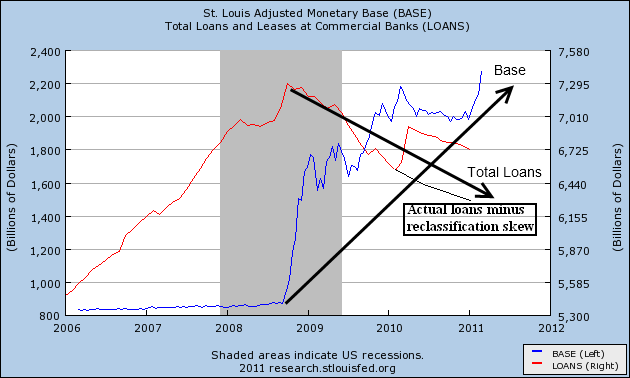

Over the years many have been quick to cite the monetary base as the direct transmission mechanism that would lead to the great hyperinflation. We all know the story – the Fed’s balance sheet explodes, the monetary base shoots higher and money starts flowing out of bank vaults like a volcanic overflow. But regular readers are all too aware that the monetary base has no correlation with the broader money supply. The reasoning is simple – the money multiplier is a myth. So, it doesn’t matter how many apples (reserves) the Fed puts on the shelves. It doesn’t result in more apple sales (loans). Banks are never reserve constrained. The explosion in reserves and continuing decline in loans makes this crystal clear. The Fed can continue to stuff banks with reserves and unless we see a substantive increase in lending the expansion of the monetary base will continue to be insignificant.

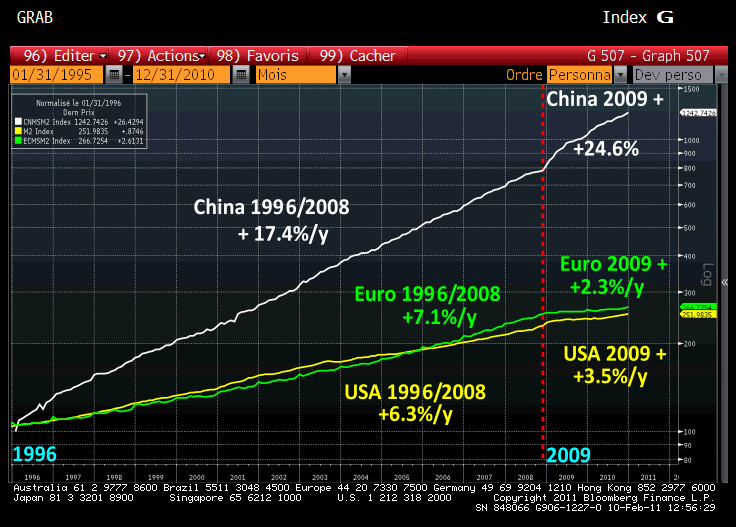

But what about M2? Isn’t it also exploding higher now? Not really. In a recent article Erwan Mahe, an asset allocation and options strategist with OTCexgroup, posted this excellent chart comparing M2 growth across the big three economies. He said:

“As you can see in this graph, China literally allowed its money supply to skyrocket, compared to that of the U.S. or the eurozone, with annual growth averaging +17.4% between 1996 and 2008, which compares to +7.1% in the eurozone and +6.3% in the United States.

Above all, since the beginning of 2009, this divergence has actually widened, despite the Fed’s QEs and 0% interest rates, since Chinese M2 has been growing at 26.6% per annum (!), versus +3.5% in the U.S. and +2.3% in the eurozone.

So, I wonder, is Bernanke truly responsible for the hike in world commodity prices and the ensuing popular upheavals?”

The story here couldn’t be more self explanatory. The US M2 money supply is simply not expanding anywhere close to its historical rate. The only country where the M2 money supply is seeing any sort of substantive growth is in China. And so it’s not surprising to see the combination of commodity hungry China and enormous money supply growth result in higher commodity prices. While I don’t think it’s incorrect to blame some speculative aspect of this rally on the Fed it is entirely incorrect to blame the Fed for the commodity rally due to their “money printing”. The fact is, the USA is not expanding the money supply at an alarming rate. China controls their own money supply. If they desire to print money in order to maintain their flawed currency peg then that’s a policy only they can control. Blaming the Fed for China’s flawed monetary policy is not even remotely fair.

Although the USA stopped issuing M3 we can still measure M3 through various independent sources. Hyperinflationists are often quick to point out Shadow Stats when anyone cites the CPI. Ironically, according to their data the M3 money supply is still shrinking at an annualized rate:

So yes, the US government is running a massive $1.5T deficit, however, by any metric of money supply we can see that this is barely offsetting the continued de-leveraging that is occurring across the US economy. We are certain to see higher rates of inflation in 2011 (especially if oil prices surge higher), however, it is not an accurate portrayal of reality to conclude that the USA is “printing money” uncontrollably and flooding the world with dollars that will lead to hyperinflation. That is simply not the case and the data speaks for itself. At best, we are barely printing enough to offset the destruction of de-leveraging….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.