Last week’s volatile action in the markets began to show some of the confusion that market participants are experiencing. Much of this confusion has been due to QE2 and the uncertainty regarding the end of the program. As we near the end of the program it’s difficult to ascertain exactly what QE2 has done. One thing is clear, however – QE2 has contributed to significant speculation in markets. This has been most apparent in the continuing surge in margin debt. I discussed this a few weeks:

As we noted earlier this year, margin debt has tended to correlate fairly closely with the direction of the equity market. And according to the latest data from the NYSE, margin debt continues to move higher. In an effort to ride the coattails of the Fed and QE2′s “can’t lose” environment, investors have dipped into their borrowings to buy equities. David Rosenberg highlights the speculative fervor that this now represents. Current levels of margin debt are now consistent with the Nasdaq bubble and just shy of the levels seen before the credit crisis (via Gluskin Sheff):

“If there is one sure way to tell that the Fed has managed to create and nurture a speculative-led rally in the equity market, look no further than what is happening to investor-based leverage growth – it’s exploding off the page. Yes, that’s right. Debit balances at margin accounts skyrocketed $20.7 billion in February. Only two other times historically have we seen leverage rise so much so fast and both times it was during a manic phase – during the tech bubble of the late 1990s and the credit bubble just a short four years ago.

To put that $20.7 billion incremental leverage in on month into proper perspective, it represents a 7.2% jump, or an increase of no less than 129% at an annual rate. And, it’s not just February – the rising use of credit to buy stocks has zoomed ahead at a 64% annual rate in the past three months. If and when the markets breaks, the problem in trying to contain the downside momentum is that there are no short left to cover, which actually helps as a shock absorber. The Fed has successfully cleaned out the short community, and the extent to which we see margins being called away may very well accentuate and downside pressure…if it should come.”

Late last week the CIO of a boutique investment firm emailed me with some superb thoughts on the increasing debt in financial markets. He referred to the current environment as the “financial pyramid”:

“If this financing pyramid is near correct, then prices are simply a reflection of leverage rather than an inflation of money. If there is only speculative non-bank horizontal money, then whatever commodity (non-monetary) inflation exists must be transitory, because it relies on a permanent Ponzi condition (leveraged commodities holdings that depend on prices being higher to satisfy liabilities). So it seems that the central banks distortions of the last several years are creating some imbalances that are unintended and unwanted, which is to increase speculative volatility in things like oil, which goes from $40 to $150 to $50 to $130 over and over. Paper profits change accounts but the real economy is not theoretically affected, except that it is held hostage to this casino game of rapidly changing prices for basic materials and necessities that businesses and consumers use to make decisions. So the economy is in actuality disrupted by the casino, the casino creates no net wealth, and everyone is worse off as this charade continues.”

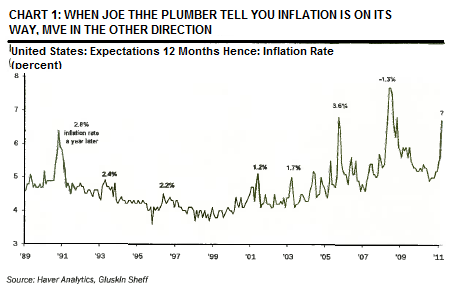

That’s one of the best summaries of the effects of QE2 I have yet seen. Most interestingly, Ben Bernanke is likely to be right about one thing – the increases in commodity prices are likely to be transitory and the continual fear mongering over high inflation is likely to be wrong. On the other hand, with growth having peaked when QE2 began, I think it’s important that policy makers begin to ask whether QE2 isn’t having a negative impact on the economy. If the air comes out of the financing pyramid I think that question will likely answer itself. Hopefully, the Fed won’t respond to any market or economic downside with more of the same misguided medicine.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.