This WSJ article about precious metals hedge funds highlights a very dangerous idea that became all too popular in recent years – the myth that unproductive assets should be a major component of any portfolio. This became a very popular idea among big hedge fund names in recent years as gold’s rally led many to believe that they could better protect their portfolios by establishing substantial stakes in gold and other precious metals.

This idea became even more popular as many prominent people assumed that QE and its “money printing” would cause runaway inflation. Of course, they were not only misinterpreting how QE works, but they were misinterpreting how the monetary system works and that led them to construct their portfolios poorly.

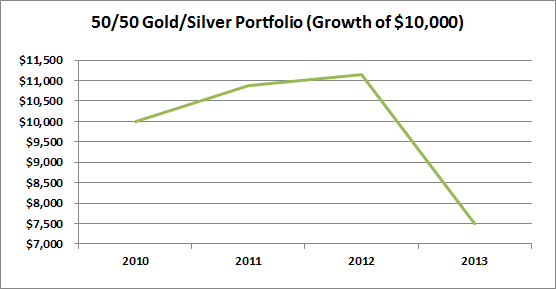

To be fair, gold and silver haven’t performed poorly over a longer time frame. This is more a case of “what have you done for me lately”, but we’re now pretty deep into a disastrous bear market in precious metals. $10,000 invested in a 50/50 gold/silver portfolio at the beginning of 2010 is down 25%.

Now, I don’t mind a small stake in gold and there’s even some logic behind such a position in a negative real interest rate environment, but be wary of anyone who’s selling the idea that you should pile your savings into gold and silver. This has the potential to be a very dangerous way to construct a portfolio and in my opinion it’s largely based on misunderstandings of the monetary system and the financial world more broadly.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.