The slowing growth of the global economy has many people confused about what’s going on. There are all sorts of explanations out there including the “secular stagnation” theory, the “New Normal”, the “rise of the robots”, etc. But what if the “new normal” and “secular stagnation” are merely the normal normal?

Thomas Piketty put things in perspective for us in his popular book “Capital” when he discussed the long-term trends in growth. Piketty estimated that growth would slow as the return on capital would increase. Here’s how I explained it in my review of the book last year:

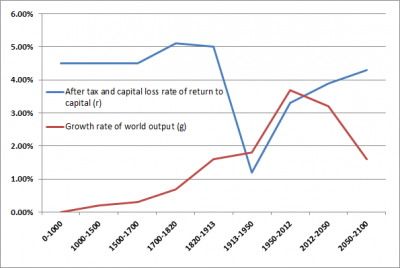

He estimates that the growth rate of world output will decline substantially in the coming century as the return on capital will surge. In essence, both are mean reverting to some degree. But if growth is reverting to the mean then the “secular stagnation” thesis is a myth. In fact, it means that we’ve been in a “secular boom”. But worse, it means that during this era of great “inequality” growth has boomed. This contradicts the “secular stagnation” thesis. In fact, this appears to add some credence to the view that periods with inequality can coincide with periods where “a rising tide lift all boats” to some degree.

You’ll notice something pretty important there. Growth was unusually high in the 1900’s. And that raises an interesting possibility. Maybe the new normal is not the new normal at all. Perhaps we’ve been spoiled by recent high growth and the new normal is actually the normal normal. Perhaps we’re just suffering from a massive case of recency bias by assuming that the 3.5% growth of the 1900’s was normal.

Said differently, maybe slower growth is here to stay because the high growth that many became accustomed to was never sustainable to begin with. The Great Normalization is underway now that the unsustainable “normal” has passed. And given that this growth is actually proving to be much more stable than the 1900’s, it might not actually be such a bad thing after all.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.