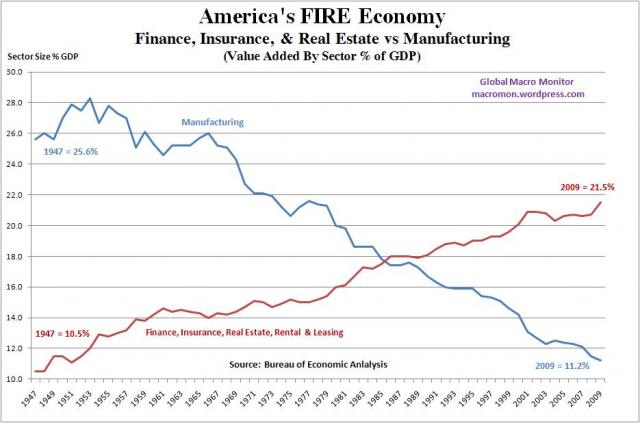

Great chart here from Macromon (via Ritholtz) on the growth of the F.I.R.E. (Finance, Insurance & Real Estate) industry and the shrinking of the manufacturing base. Now, granted, some of this is merely due to greater productivity, efficiency, etc. On the other hand, what accounts for the growth in the FIRE industry? Why has the capitalist system in America attributed such a high value on these industries that produce little and take so much?

I have said in the past that this growing divide is bad for the future of the country (read similar commentary from Bill Gross here), but you simply can’t argue with the fact that much of this growth in the financial sector is due to increased demand for these services. Is the marketplace incorrectly attributing this value or is this growth justified? If so, how can it ever be reversed?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.