The private sector debt problem is no secret although the mainstream media is still blinded by the supposed public sector debt problem. Of course, there is no public sector debt problem in the USA so it’s not surprising that the economy remains in a funk while policymakers fail to focus their efforts on the right problems.

On Friday I posted an update on the status of the long running balance sheet recession. Over the weekend, the Wall Street Journal ran an excellent piece putting the problem of household debt into perspective:

$26,172: Amount of debt the average U.S. household would need to cut to bring balance sheets back to 1990s levels.

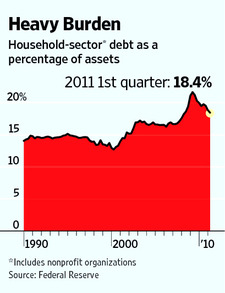

“…In the first quarter, households owed $13.3 trillion, an amount equal to 18.4% of total household assets, including stock portfolios, savings and homes, according to the Federal Reserve‘s flow of funds report. That was down from 21.7% two years earlier but still well above the 14.4% level that prevailed in the 1990s. That suggests household balance sheets don’t have nearly enough cushioning against financial shocks, like job loss and illness, as they should.

To get back to 14.4%, households would have to shed a combined $2.9 trillion of debt. In other words, either people cut their credit cards up like crazy, or they keep putting their keys in the mailbox and walking away.

Another way: Increase household assets by $20.4 trillion — a 30% gain that would all but wipe out real estate losses and take the stock market to a new all-time high. History suggests that day will eventually come, but given the current state of the financial and housing markets, it seems unlikely to come quickly.”

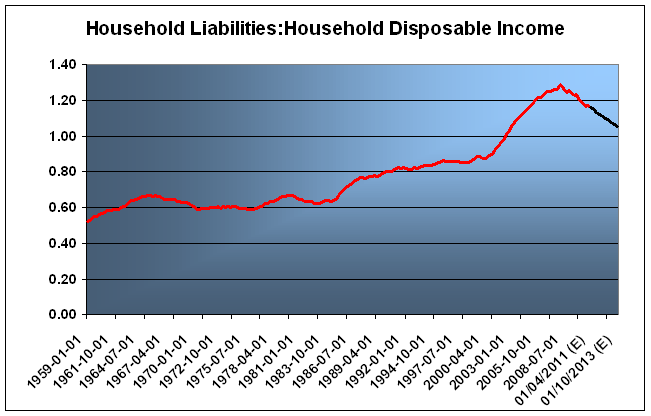

That’s an excellent summary of the issue. Earlier this year, I provided an analysis showing how and when the balance sheet recession might end. I said:

“At the current trajectory it’s not unreasonable to assume that the balance sheet recession will last well into 2012 and potentially longer. While a 1:1 ratio is “sustainable” by my estimates, it would be comforting to see levels closer to the historical levels in the 80% range. If that is the case we could see the impact of the balance sheet recession persist far longer than anyone believes. The obvious upside risk is a dramatic improvement in the labor market. On the other hand, our government is now explicitly encouraging fiscal imprudence in an attempt to “keep asset prices higher than they otherwise would be”. This sort of policy has the very real potential to increase instability and turnrecovery into bubble. Other exogenous risks (Europe, China, housing prices, etc) also pose substantial risks to the downside. For now, I think it’s safe to assume that the recovery will remain fairly fragile well into 2012, but given the size of the deficit and potential for labor market improvement we could see continued economic strength.”

This still very much applies today. I don’t necessarily think we have to get back to the 1990 debt levels as the WSJ piece implies, but we must see incomes come back in-line with total debt levels in order to allow for proper servicing of these debts. The Fed is convinced they can fix this issue via their wealth effect, however, as I’ve repeatedly noted, this economy requires real wealth expansion and not just nominal wealth increases based on speculation. Unfortunately, there are no quick fixes here. And as the WSJ notes, there’s really only one thing that can heal the balance sheet recession – time. In the meantime, we should remain cognizant of our issues and ensure that we don’t repeat the mistakes of Japan and Europe.

Update – Some readers have noted that this analysis does not break down the issues by class and income. This is true and I am painting the picture a brush that is a bit too broad. Readers might be interested in the following paper which succinctly summarizes the growing issue of debt and its effect on income disparity and unevenness in the US economy.

https://www.levyinstitute.org/pubs/wp_589.pdf

Update 2 – I’ve also updated this with a new post here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.