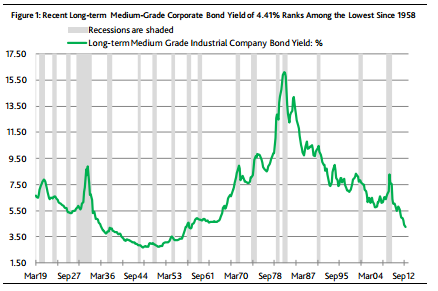

There’s a been a huge amount of discussion in recent weeks about how expensive corporate bonds are. But here’s a different take. Moody’s says corporate bond yields could continue to follow Fed and & ECB policy lower. In fact, a quick look at the historical yields shows that these’s still ample room on the downside in corporate credit. Obviously we’re just looking at nominal yields as opposed to running any fancy valuation analysis, but as you likely know, bull markets have a tendency to overshoot so Moody’s bullish argument isn’t totally irrational. In fact, as long as the Fed remains so accommodative it will probably take a substantial change in the economic landscape to force corporates to diverge from govies

Here’s Moody’s:

“Roughly a year ago, the consensus projected fourth-quarter 2012 averages of 3.7% for the 30-year Treasury yield and 5.6% for Moody’s long-term Baa corporate bond yield. As derived from the yield forecasts of late 2011, the implied yield spread of the Baa corporate bonds over Treasuries was 190 bp. Recently, the Baa corporate bond yield of 4.71% was well under the consensus projection of late 2011. The much-lower-thananticipated Baa corporate bond yield followed from a lower-than-anticipated 30-year Treasury yield of 2.99% and a narrower-than-expected Baa bond spread of 172 bp. (Figure 1.)”

…

“What markets did not fully appreciate during late 2011 was the extent to which Treasury bond yields would

be reined in by Federal Reserve policy. In addition to the Fed, other central banks did their utmost to reduce the danger of a global relapse. By stepping up its commitment to stabilizing Europe, the European Central Bank (ECB) did much to allay investor fears and narrow credit spreads.”

Source: Moodys

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.