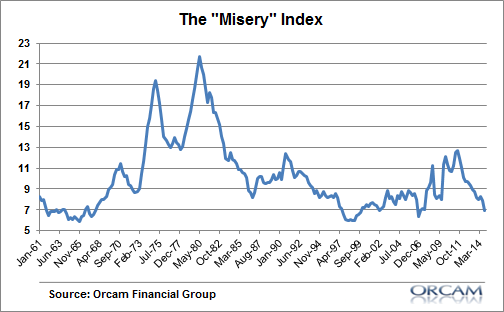

The misery index is the summation of the rate of inflation and the rate of unemployment. It’s named aptly because a high rate of inflation and high unemployment are, well, miserable things to experience. Where is the index today? It’s at an 8 year low. And perhaps more interestingly, today’s Misery level of 6.9% is well below the 70 year average of 9.5%.

Of course, some people will argue that the CPI isn’t an accurate reflection of prices or that the U3 unemployment rate isn’t an accurate reflection of employment. But even if we use something like Shadow Stats’s phony inflation index (which has been misleading investors and pundits for years) then the rate of inflation is still nearing a 20 year low:

And as I showed the other day, the U6 unemployment rate is 11.3%, just 0.5% shy of the 30 year average. Unfortunately, many people prefer to view this sort of data through the eyes of an ideology as opposed to trying to view it through an objective lens. And this is the sort of thinking that has led to all sorts of bad predictions about QE, high inflation, the “fake” stock market rally, rising interest rates, surging gold prices, etc.

The truth is, maybe things aren’t so miserable after all?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.