The markets were up big yesterday on the back of the “no taper” decision by the Fed. This doesn’t surprise me too much. In recent Orcam Research notes I’ve been discussing how the current market fears (the “taper”, the Syria “crisis”, the “debt ceiling”, etc) were all being blown way out of proportion and that buying into the market weakness was the prudent way to approach things. But there seems to be some confusion in some circles about the idea that QE is just an “asset swap” and has also coincided with big market moves.

I like to think of the QE programs as a number of different policies that have to be analyzed on their own. For instance, QE1, in which the Fed was making a market in severely discounted assets, is substantially different than buying assets that are substantially more risky. For instance, most MBS assets the Fed buys these days have substantial prepayment risk and are selling at a premium, which is a big part of why they got whacked so badly in the last few months. QE1 was actually somewhat close to “Roche’s Bag-O-Dirt” which I’ve discussed in recent weeks because it created huge capital gains for the owners of those assets by having the Fed guarantee that the assets would be worth 100 cents on the dollar. QE2 and QE3 were implemented in totally different environments so their effects have been different and I think the impact on assets has been more muted.

More importantly, it’s helpful to think of QE within the scope of broader economic trends. In the 2009-20012 period the US Government was running substantial budget deficits while the private sector was de-leveraging. So if you viewed QE as an “asset swap” and then considered aggregate government policy where they were adding $1 trillion in net financial assets every year via bond issuance then QE had the appearance of being highly expansionary mainly because fiscal policy was so expansionary.

But what about an environment like today where private investment is picking up and the deficit is shrinking? Well, again, the “asset swap” is being complemented by further debt expansion in the private sector and a deficit that, while shrinking, is still 5% of GDP. In other words, QE could literally be doing nothing and other factors at work explain perfectly fine why the markets and the economy continue to expand. Now, I don’t think QE does “nothing”, but I do think it’s a lot less impactful, as implemented at present, than some others presume.

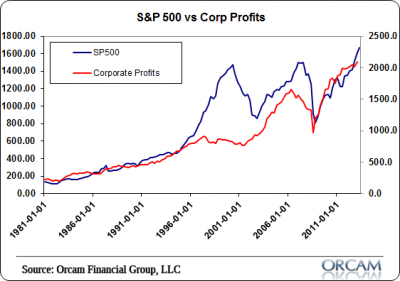

Now, some economists like to ohhh and ahhh at every tick in the market and declare how it “proves” what they previously thought. Maybe it does. Personally, I view stock prices as a reflection of future expected profits so current prices are really just guesses about future underlying corporate performance and extrapolating too much more than that is dangerous. But we know for a fact that private investment and government deficits add to corporate profits. And we know that the government has run humongous deficits for 5 years straight and we know that private investment is approaching all-time highs. We also know that profits and market performance are closely linked. And we know that corporate profits are at all-time highs. So, if QE does less than some people think, then the recent overall stock market performance combined with a 5% government deficit, improving private sector debt accumulation and improving private investment all meshes perfectly with a rising stock market because there has been real fundamental improvement in balance sheets.

Anyhow, for those of us who have analyzed the economy in aggregate and taken into consideration the improvement in the private sector, the continuing high budget deficit and the pick-up in private sector debt demand, there’s really nothing surprising about the market rising in tandem with or without QE. It all makes perfect sense if you understand the flow of funds and the sectoral balances. That doesn’t mean QE has done nothing or that different versions of QE haven’t been important, but I don’t think it’s accurate or useful to look at one day’s market performance and declare that it proves or disproves something.

Related:

Understanding Quantitative Easing

NB – The title of this post was prompted by Mark Sadowski at The Money Illusion. I think Mark dislikes me due to my criticism of Market Monetarism at times, but I am pretty sure we’re going to be best friends before all is said and done. Or maybe worst enemies. Who knows. But I am sure we’ll all learn a lot along the way….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.